BALTIMORE (Stockpickr) -- The drama surrounding the government shutdown held a gun to Wall Street's head to start the week. Well, kinda, sorta.

Stocks actually held their ground pretty well in spite of yesterday's headlines. And the sky isn't falling today either.

In fact, looking back on a historical basis since 1976, research from Bank of America Merrill Lynch's Equity and Quant Strategy group shows that markets tend to perform well in the wake of a government shutdown threats on Capitol Hill. The timing is pretty good too: "New month, new market" has been stocks' mantra all year long. So investors should brace themselves for more of the same now that October trading kicked off at the opening bell this morning.

To take full advantage of a change in trend, we're taking a technical look at five stock trades worth trading this week.

For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution.

So, without further ado, let's take a look at five technical setups worth trading now.

Atlas Pipeline Partners

Up first is natgas pipeline stock Atlas Pipeline Partners (APL). Natural gas spot prices have sported some pretty lackluster performance so far in 2013, tumbling mid-single digits year-to-date, but not APL. APL has managed to claw its way nearly 22% higher since the calendar flipped over to January, and it's positioned for even better performance for the rest of the year.

APL is currently forming an ascending triangle pattern, a bullish setup that's formed by horizontal resistance above shares at $39.25 and uptrending support to the downside. Basically, as APL gets bounced in between those two technical levels, it's getting squeezed closer and closer to a breakout above resistance. When that happens, traders have their buy signal.

Whenever you're looking at any technical price pattern, it's critical to think in terms of those buyers and sellers. Ascending triangles and other pattern names are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That resistance level at $290 is a price where there has been an excess of supply of shares; in other words, it's a place where sellers have been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $290 so significant -- the move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Wait for $290 to get taken out before you buy.

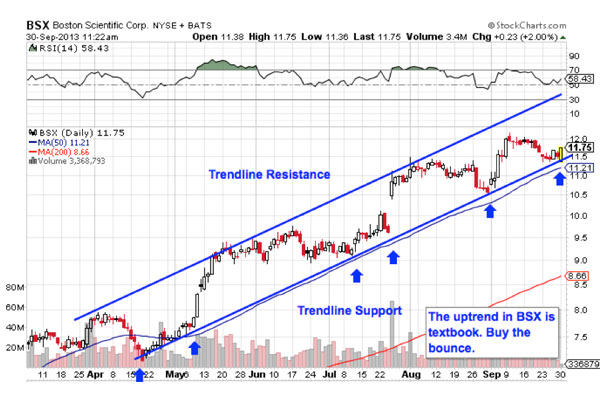

Boston Scientific

You don't have to be an expert technical analyst to figure out what's going on in shares of Boston Scientific (BSX). Shares of the $16 billion medical device maker have been bouncing higher in a textbook uptrend for the better part of the year. Now, with shares coming down to test support, we're coming up on a big buying opportunity for this stock.

BSX has been stuck in a tight range in between parallel uptrend lines, levels that provide a high-probability range for shares. While there's really no bad time to buy a stock that's in an uptrend, the ideal time to jump in comes on a bounce off of trendline support. Buying off a support bounce makes sense for two big reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong).

The 50-day moving average has been a stellar proxy for support on the way up -- it's where I'd put a protective stop in this name.

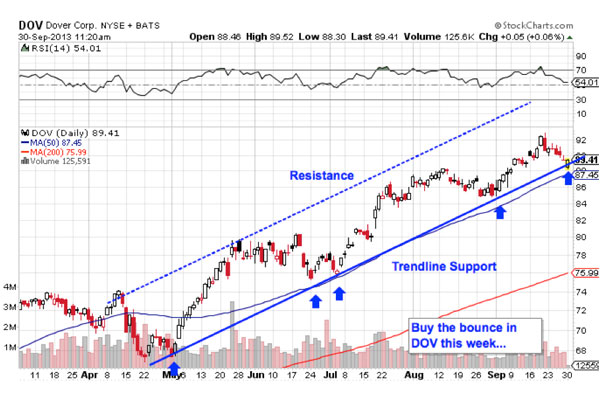

Dover

Dover (DOV) is another stock that's in a solid uptrend this fall. Like BSX, the manufacturing conglomerate has been trending higher since the start of the summer – beating the S&P 500 on a relative strength basis all the way up.

And just like BSX, the ideal time to buy comes on a bounce off of trendline support.

DOV pushed higher off of support in yesterday's session, catching a bid before it got down to the 50-day moving average. At this point, Dover's bounce is still a little tentative. While buyers did step in and bid shares up, yesterday's price action left things close to the support line. So while now might be a good time to build a starter position in DOV, I'd recommend waiting for a more confirmed more off of support before putting cash on this trade.

If you decide to jump in here, keep a tight protective stop in place.

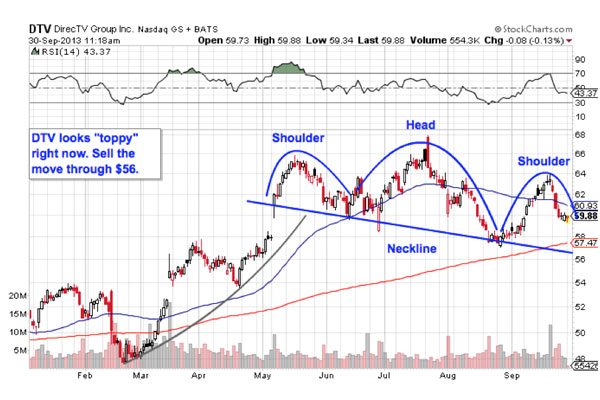

DirecTV

Last up is satellite television operator DirecTV (DTV). While DTV has more or less matched the market so far this year, shares of the TV provider are starting to look a little "toppy" now. Here's how to trade it.

DirecTV is forming the late stages of a head and shoulder top, a reversal setup that indicates exhaustion among buyers. The head and shoulders is formed by two swing highs that top out around the same level (the shoulders), separated by a bigger peak called the head; the sell signal comes on the breakdown below the pattern's "neckline" level, which is right above $56 at the moment for DTV.

The head and shoulder pattern is well know because it works: a recent academic study conducted by the Federal Reserve Board of New York found that the results of 10,000 computer-simulated head-and-shoulders trades resulted in "profits [that] would have been both statistically and economically significant." If you decide to short this stock on a move below $56, it makes sense to keep a stop above $64.

To see this week's trades in action, check out the Technical Setups for the Week portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

No comments:

Post a Comment