52-Week Lows

Philanthropy is an important component of many wealth planning conversations, but advisors and their affluent clients often have different perceptions centering on the initiation and substance of those discussions, according to a new study. U.S. Trust and The Philanthropic Initiative conducted a nationwide survey in August of some 300 advisors — including wealth advisors, trust and estate attorneys, accountants and other tax professionals — and a random sample of 120 individuals with $3 million or more in investable assets who were actively engaged in charitable giving. The study found that 89% of advisors said they discussed philanthropy with at least some of their clients, and 71% regularly asked clients about their interest in charitable giving. Meanwhile, only 55% of wealthy individuals said they had discussed philanthropy with a professional advisor. Advisors and individual respondents also differed on who initiated the philanthropic discussion (33% of advisors said they did, while 51% of individuals said they had initiated it), and on how early in the client relationship the discussion should begin (most of the individuals said it should happen within the first several meetings, while many advisors preferred to wait until they knew more about their clients personal, financial and philanthropic goals). “The vast majority of wealthy individuals give to charity, and many cite charitable giving as one of the greatest freedoms of wealth,” Claire Costello, national philanthropic practice executive for U.S. Trust, Bank of America Private Wealth Management, said in a statement, referring to an earlier study. “Philanthropy today is no longer simply what one does with ‘what’s left,’ but rather a pivotal consideration at the front end of the wealth structuring process. For this reason, we are seeing individuals and families rely increasingly on advisors to help them integrate their philanthropic pursuits into their overarching wealth plan.” The study also found that only 41% of affluent respondents were fully satisfied with the philanthropic conversations they had with their advisors. The study pointed to one possible reason: 71% of advisors said they raised the philanthropic discussion from a technical perspective — focusing on tax considerations or wealth structuring, for example — compared with 35% who did so beginning with their clients’ philanthropic goals or passions. Once initiated, 41% of advisors said further philanthropic discussions also centered on technical issues, compared with 38% who talked more about clients’ charitable goals. Individual respondents reported otherwise, with 63% finding that ensuing discussions with their advisor about charitable giving tended to center on more technical issues, while just 27% said these discussions centered on their charitable goals, values and interests. Despite these disconnects, 73% of wealthy individuals who discussed philanthropy with an advisor believed such conversations were important, and 82% felt their advisor played an important role in their charitable giving. Both advisors and HNW respondents agreed that the chief motivations for the latter’s philanthropy were being passionate about a cause, having a strong desire to give back and having a positive effect on society and the world. After that, however, reasons provided by HNW individuals and advisors differed significantly. Individuals said their next three most for giving were to encourage charitable giving by the next generation (30%), religious or spiritual motivations (23%) and because they believe giving back is an obligation of wealth (22%). Advisors believed their clients’ next most popular motivations would include reducing their tax burden (46%), religious or spiritual reasons (41%) and creating a family legacy (30%). In fact, just 10% of individual respondents cited reducing taxes among their motivations for giving. The disconnect on the topic of taxes went deeper, with advisors believing that 40% of HNW individuals would reduce their giving if the estate tax were eliminated, and that 78% would do so if income tax deductions for donations were eliminated, whereas just 6% and 45% of individuals, respectively, said they would reduce their charitable giving if these tax policy changes occurred. --- Check out Shutdown Plays Havoc With Federally Funded Nonprofits on ThinkAdvisor.

Erik Schelzig/APWorkers assemble a Volkswagen Passat at the German automaker's Chattanooga, Tenn., plant. DETROIT -- Volkswagen AG and the United Auto Workers said they are in talks about the U.S. union's bid to represent workers at the German carmaker's Tennessee plant, which would be a milestone in the UAW's long-running effort to organize foreign-owned auto plants. Volkswagen officials, in a letter distributed to workers at the Chattanooga, Tenn., plant Thursday night and Friday morning shifts, said worker representation at the plant can only be realized by joining with a U.S. trade union. "In the U.S., a works council can only be realized together with a trade union," Fischer's letter says. "This is the reason why Volkswagen has started a dialogue with the UAW in order to check the possibility of implementing an innovative model of employee representation for all employees." The letter to the 2,500 Chattanooga workers was signed by Frank Fischer, chief operating officer and manager of the plant, and Sebastian Patta, head of human resources in Chattanooga. UAW President Bob King has been trying without success thus far to organize foreign-owned, U.S.-based auto plants to bolster membership in the union, which has fallen from its peak in the late 1970s. The UAW has been working with the German union IG Metall to try to organize workers at the Volkswagen plant. King is open to what Fischer called "an innovative model" in order to gain acceptance by workers at foreign-owned auto plants, which are primarily in the U.S. South. "VW workers in Chattanooga have the unique opportunity to introduce this new model of labor relations to the United States, in partnership with the UAW," the UAW said in a statement Friday morning. "If Bob King can get his foot in the door at Chattanooga, even if it's just a works council, it's pretty significant," a former auto executive at a foreign automaker with U.S. plants, who wished to remain anonymous, said earlier this week. On Wednesday, during a call about Volkswagen's U.S. sales, Jonathan Browning, head of the company in the United States, said: "We've been very clear that that process has to run its course, that no management decision has been made and that it may or may not conclude with formal third-party representation." Browning also said that ultimately, the decision on whether to have third-party representation will be decided by Chattanooga's workers by a formal vote. There was no indication in the letter to workers when such a vote would be held. The UAW also confirmed that King met last Friday with VW executives and officials from the company's "global works council," which represents VW blue- and white-collar employees around the world. The UAW said last week's meeting, "focused on the appropriate paths, consistent with American law, for arriving at both Volkswagen recognition of UAW representation at its Chattanooga facility and establishment of a German-style works council." At VW plants, workers are represented by so-called works councils, which include laborers as well as executives who cooperate to determine issues ranging from company strategy to job conditions. They do not negotiate wages or benefits. Volkswagen has about 100 plants worldwide, and all of them except for the Chattanooga factory and the company's six plants joint venture plants in China have such a council, an expression of the company's belief in what it calls "co-determination." While the UAW, and VW in its letter to Chattanooga workers, say that a U.S. trade union must be allied with any group of workers at a foreign-owned company, some disagree. "Volkswagen workers can discuss their work with their employer without UAW unionization," Mark Mix, president of the anti-union National Right to Work Foundation, said in a statement Thursday. "The UAW's campaign of misrepresentation is meant only to misinform workers into thinking that they have no choice but to unionize," Mix said. The anti-union organization is based in Virginia. By Michael Zak | AOL Autos 5 Best China Stocks For 2014: ChinaEdu Corporation(CEDU) ChinaEdu Corporation, together with its subsidiaries, provides educational services to the online degree programs of universities in the People?s Republic of China. It also offers online tutoring services to primary and secondary school students; operates primary and secondary schools; and markets international English language curriculum programs to established learning institutions, as well as international polytechnic programs to vocational schools in China. The company?s online degree programs offer associate and bachelor?s degree programs, including accounting, marketing, finance, business administration, international business, law, civil engineering, education, computer science, literature, project management, marketing, and administrative management. These online degree programs primarily target working adults. Its services also include academic program development, technology services, enrollment marketing, recruiting, student support services, and finance operati ons. The company provides technical, recruiting, and other services for the online degree programs of 27 universities; and technology support services to 7 additional universities that are awaiting regulatory approval to launch their online degree programs. As of December 31, 2010, it served approximately 311,000 online degree programs students, as well as approximately 51,450 students in other businesses. ChinaEdu Corporation was founded in 1999 and is based in Beijing, the People?s Republic of China. 5 Best China Stocks For 2014: SmartHeat Inc.(HEAT) SmartHeat Inc. manufactures, sells, and services plate heat exchangers (PHE) in the People?s Republic of China. It offers PHE units, which combine PHEs with various pumps, temperature sensors, and valves and automated control systems; heat meters for use in commercial and residential buildings; and spiral and tube heat exchangers. The company?s products are used in various applications that include energy conversion for heating, ventilation, and air conditioning; and industrial use in petroleum refining, petrochemicals, metallurgy, food and beverage, and chemical processing. SmartHeat sells PHE units under the brand name of Taiyu; and PHEs under the brand names of Taiyu and Sondex. It sells its products through sales force and a network of national distributors. The company is headquartered in Shenyang, the People?s Republic of China. Bona Film Group Limited distributes films in the People?s Republic of China. It distributes films to movie theaters, as well as to non-theatrical distribution channels, including DVD and Blu-ray and other home video products; Internet and digital distribution; in-flight entertainment; and cable, satellite, and broadcast televisions. The company also invests in the production of Chinese and Hong Kong films in order to obtain the distribution rights for movie theaters and non-theatrical channels. In addition, Bona Film Group operates six movie theaters in five cities of the People?s Republic of China; operates a talent agency business that represents artists; and involves in film advertising and television production businesses. The company was founded in 2003 and is headquartered in Beijing, the People?s Republic of China. Advisors' Opinion: - [By Seth Jayson]

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Bona Film Group (Nasdaq: BONA ) , whose recent revenue and earnings are plotted below. - [By Bryan Murphy]

With just a quick glance at the chart, Bona Film Group Ltd (NASDAQ:BONA) doesn't look like anything other than an erratic mess. When you take a step back and take a look at the longer-term chart of BONA, however, you can see the last several weeks have ushered in a major bullish change of direction for the stock... meaning now's a great time to start wading into a position.

5 Best China Stocks For 2014: Trina Solar Limited(TSL) Trina Solar Limited, through its subsidiaries, designs, develops, manufactures, and sells photovoltaic (PV) modules worldwide. The company offers monocrystalline PV modules ranging from 165 watts to 185 watts in power output; and multicrystalline PV modules ranging from 215 watts to 240 watts in power output that provide electric power for residential, commercial, industrial, and other applications. It also involves in the design and production of various PV modules, such as colored modules for architectural applications and larger sized modules for utility grid applications based on customers? and end-users? specifications. Trina Solar Limited sells and markets its products primarily to distributors, wholesalers, power plant developers and operators, and PV system integrators. The company was founded in 1997 and is based in Changzhou, the People?s Republic of China. Advisors' Opinion: - [By Lauren Pollock]

Trina Solar Ltd.(TSL) swung to a surprise third-quarter profit after better than expected demand in China drove up company shipments and led to strong revenue growth. American depositary shares surged 11% to $18.04 premarket. - [By Paul Ausick]

DJIA stocks on the move: Lions Gate Entertainment Corp. (NYSE: LGF) hit a new 52-week high of $35.13 on Wednesday. Trina Solar Ltd. (NASDAQ: TSL) rose more than 15% after posting better than expected earnings on Tuesday, Aeropostale Inc. (NYSE: ARO) put up a new 52-week low of $11.40, and another teen retailer, and American Eagle Outfitter Inc. (NYSE: AEO) also put up a new low of $14.33.

5 Best China Stocks For 2014: Top Image Systems Ltd.(TISA) Top Image Systems Ltd. provides enterprise solutions for managing and validating content entering organizations from various sources. It develops and markets automated data capture solutions for managing and validating content gathered from customers, trading partners, and employees. The company?s solutions deliver digital content to the applications that drive an enterprise by using technologies, such as wireless communications, servers, form processing, and information recognition systems. It offers eFLOW Unified Content Platform that provides the common architectural infrastructure for its solutions. The company also provides Smart, an automated classification solution, which is the eFLOW plug-in for unstructured content providing single point of entry for information entering the organization; and Freedom, the eFLOW plug-in for semi-structured content that enables customers to identify and capture critical data from semi-structured documents, such as invoices, purchase orders, shipping notes, and checks. In addition, it offers Integra, the eFLOW plug-in for structured content, which provides a solution for data capture, validation, and delivery from structured predefined forms; eFLOW Ability, an integrated module interfacing with SAP systems for automated parking, approval, and posting of invoices and other document within SAP systems; and eFLOW Invoice Reader, an invoice capture and approval solution, which could be deployed and integrated in enterprise accounting environment, such as SAP, Oracle, and other financial systems. Top Image Systems Ltd. sells its products through a network of value-added distributors, systems integrators, original equipment manufacturers, and partners in approximately 40 countries worldwide. It has strategic partnership with SQN Banking Systems (SQN) to incorporate SQN's fraud detection solutions with its eFLOW Banking Platform in the Asia Pacific market. The company was founded in 1991 and is headquartered i n Ramat Gan, Israel.

For video game players, the arrival of Xbox One is a big day. But what does Xbox mean for the business of Microsoft? With a replacement for outgoing CEO Steve Ballmer looming, there has been a lot of chatter about whether Microsoft should spin off its Xbox business. The Associated Press has a detailed breakdown of the pros and cons of keeping Xbox, which some suggest distracts the company from its computing business. While Xbox has been profitable over the last several years, Microsoft is expected to lose at least $1 billion next year. Shares of Microsoft are up slightly, but could spike if they choose to spin off Xbox. "If you're trying to bring in new management here and have a course correction, I think this is one of the places you've got to take a look at and reassess," Nomura analyst Rick Sherlund tells the AP. Video game consoles are expected to rake in lots of money for manufacturers. Gartner forecasts video game market revenue will hit $111 billion by 2015, with roughly half of that coming from new consoles from Sony and Microsoft. However, Sony enters the space with a huge price advantage. The PS4 sells for $399, while Xbox One carries a $499 price tag. Meanwhile, Pandora shares are up nearly 1% after reporting a loss of $1.7 million in the third quarter. According to Bloomberg, the company is spending more money on development and marketing as new competitors enter the streaming music business. Follow Brett Molina on Twitter: @bam923.

BALTIMORE (Stockpickr) -- The drama surrounding the government shutdown held a gun to Wall Street's head to start the week. Well, kinda, sorta. Stocks actually held their ground pretty well in spite of yesterday's headlines. And the sky isn't falling today either. In fact, looking back on a historical basis since 1976, research from Bank of America Merrill Lynch's Equity and Quant Strategy group shows that markets tend to perform well in the wake of a government shutdown threats on Capitol Hill. The timing is pretty good too: "New month, new market" has been stocks' mantra all year long. So investors should brace themselves for more of the same now that October trading kicked off at the opening bell this morning. To take full advantage of a change in trend, we're taking a technical look at five stock trades worth trading this week. For the unfamiliar, technical analysis is a way for investors to quantify qualitative factors, such as investor psychology, based on a stock's price action and trends. Once the domain of cloistered trading teams on Wall Street, technicals can help top traders make consistently profitable trades and can aid fundamental investors in better planning their stock execution. So, without further ado, let's take a look at five technical setups worth trading now. Atlas Pipeline Partners

Up first is natgas pipeline stock Atlas Pipeline Partners (APL). Natural gas spot prices have sported some pretty lackluster performance so far in 2013, tumbling mid-single digits year-to-date, but not APL. APL has managed to claw its way nearly 22% higher since the calendar flipped over to January, and it's positioned for even better performance for the rest of the year. APL is currently forming an ascending triangle pattern, a bullish setup that's formed by horizontal resistance above shares at $39.25 and uptrending support to the downside. Basically, as APL gets bounced in between those two technical levels, it's getting squeezed closer and closer to a breakout above resistance. When that happens, traders have their buy signal. Whenever you're looking at any technical price pattern, it's critical to think in terms of those buyers and sellers. Ascending triangles and other pattern names are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares. That resistance level at $290 is a price where there has been an excess of supply of shares; in other words, it's a place where sellers have been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $290 so significant -- the move means that buyers are finally strong enough to absorb all of the excess supply above that price level. Wait for $290 to get taken out before you buy. Boston Scientific

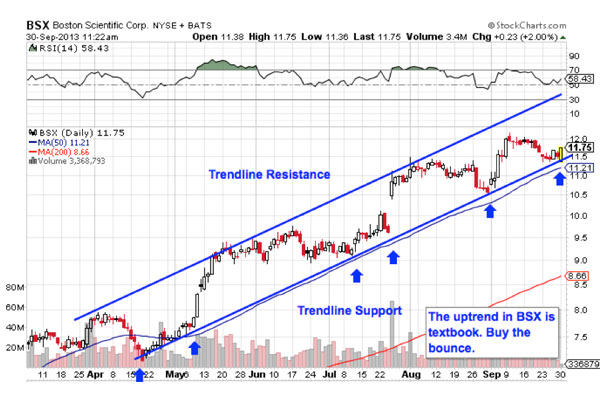

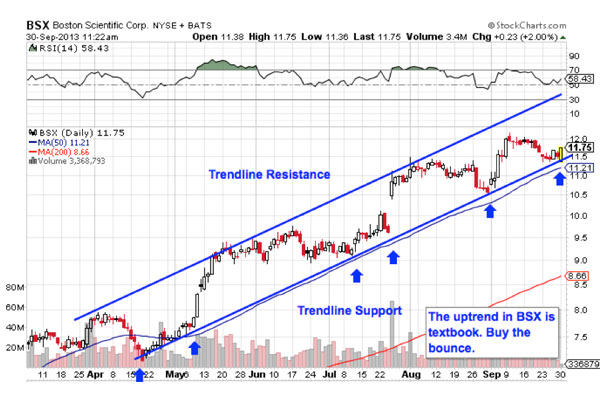

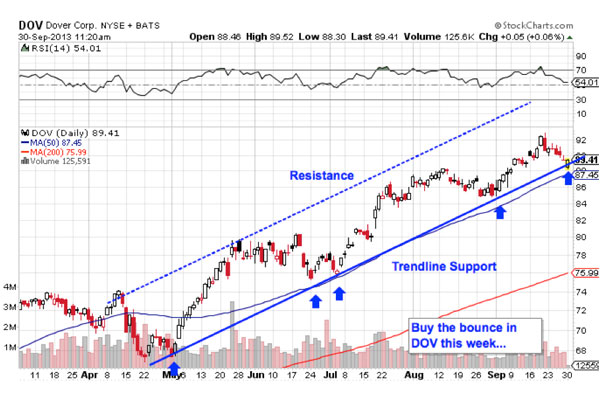

You don't have to be an expert technical analyst to figure out what's going on in shares of Boston Scientific (BSX). Shares of the $16 billion medical device maker have been bouncing higher in a textbook uptrend for the better part of the year. Now, with shares coming down to test support, we're coming up on a big buying opportunity for this stock. BSX has been stuck in a tight range in between parallel uptrend lines, levels that provide a high-probability range for shares. While there's really no bad time to buy a stock that's in an uptrend, the ideal time to jump in comes on a bounce off of trendline support. Buying off a support bounce makes sense for two big reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). The 50-day moving average has been a stellar proxy for support on the way up -- it's where I'd put a protective stop in this name. Dover

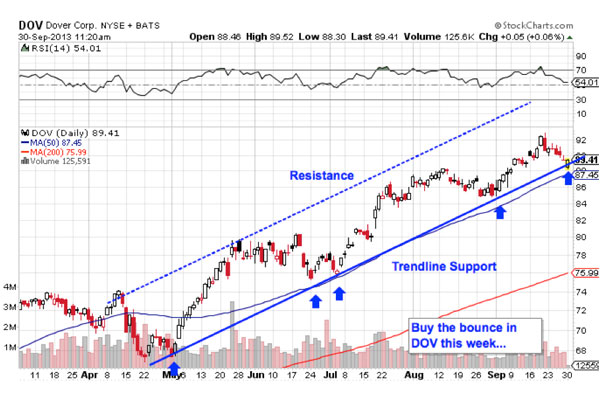

Dover (DOV) is another stock that's in a solid uptrend this fall. Like BSX, the manufacturing conglomerate has been trending higher since the start of the summer – beating the S&P 500 on a relative strength basis all the way up. And just like BSX, the ideal time to buy comes on a bounce off of trendline support. DOV pushed higher off of support in yesterday's session, catching a bid before it got down to the 50-day moving average. At this point, Dover's bounce is still a little tentative. While buyers did step in and bid shares up, yesterday's price action left things close to the support line. So while now might be a good time to build a starter position in DOV, I'd recommend waiting for a more confirmed more off of support before putting cash on this trade. If you decide to jump in here, keep a tight protective stop in place. DirecTV

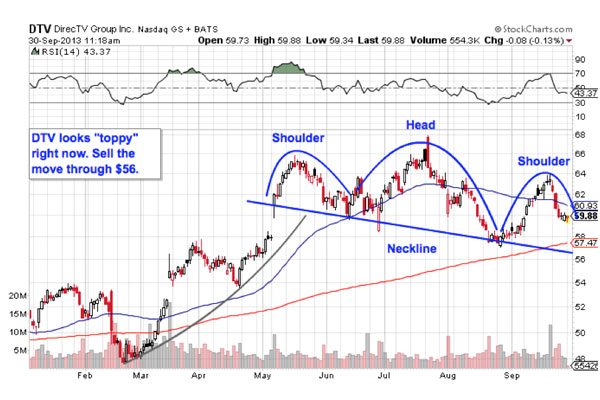

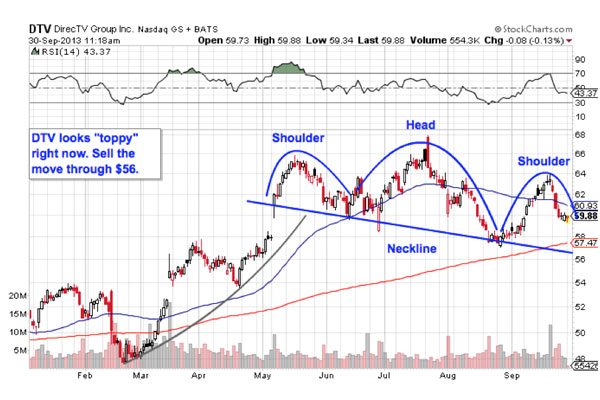

Last up is satellite television operator DirecTV (DTV). While DTV has more or less matched the market so far this year, shares of the TV provider are starting to look a little "toppy" now. Here's how to trade it. DirecTV is forming the late stages of a head and shoulder top, a reversal setup that indicates exhaustion among buyers. The head and shoulders is formed by two swing highs that top out around the same level (the shoulders), separated by a bigger peak called the head; the sell signal comes on the breakdown below the pattern's "neckline" level, which is right above $56 at the moment for DTV. The head and shoulder pattern is well know because it works: a recent academic study conducted by the Federal Reserve Board of New York found that the results of 10,000 computer-simulated head-and-shoulders trades resulted in "profits [that] would have been both statistically and economically significant." If you decide to short this stock on a move below $56, it makes sense to keep a stop above $64. To see this week's trades in action, check out the Technical Setups for the Week portfolio on Stockpickr. -- Written by Jonas Elmerraji in Baltimore.

As you're double-checking your holiday shopping list, tack on a reminder to read each store's return policy before making your purchase. Some retailers are feeling a little less generous when it comes to returns. That even includes REI, an outdoor gear and sporting goods retailer long known for its no-time-limit and no-questions-asked return policy. The store recently trimmed its return window to one year, unless the merchandise is defective. To deter "wardrobing" -- the practice of buying, using and then returning a product (usually clothing) for a refund -- Bloomingdale's recently began tagging some of its apparel with conspicuous plastic tags. If a tag is removed, shoppers can't return the item. SEE ALSO: Why You Should Start Your Holiday Shopping Now  Stingier policies are intended to combat return fraud. Last year, fraudulent returns cost retailers $8.9 billion, according to the National Retail Federation, $2.9 billion of which occurred during the holiday season. Reports of wardrobing increased 40% from 2009 to 2012, says the NRF. Customers can expect tougher return policies to spread. "As retailers see competitors or stores with some of the most lenient policies tighten up, it's going to signal to them that they can do the same," says Phoenix retail consultant Jeff Green. "We're going to see a shift toward a shorter, 30-day return policy in 2014." Customers can also expect added scrutiny when taking back merchandise without a receipt. Retailers want to identify the bad actors. To do so, some companies are gathering data on customers who return merchandise, watching for suspicious patterns and warning or denying repeat offenders. Clerks may ask for state-issued identification, such as a driver's license, before you can make a return. Nearly 10% of retailers require ID for returns made with a receipt, and 73% require ID for returns made without a receipt. Some scan the ID into their own system; others send the info to a third party. If you exceed a retailer's limit for the number of returns within a given time frame or for the value of returned products, you could be denied more returns for a period of time (typically 90 days). If you are given a warning or denied a return, the Retail Equation, a company that collects return information for 27,000 merchants in North America, will provide you with the information in its return-activity report over the phone. To request your report, visit www.theretailequation.com/consumers.  Despite the general trend toward Grinchier return policies, some retailers are giving shoppers a break during the holidays or when shopping online. Last year, 10% of retailers relaxed their return policies for the holidays, and similar promotions are expected this year. Lenient online return policies and acceptance of returns in stores for items bought online will likely continue. Look for free shipping for both purchases and returns, which Neiman Marcus debuted in October. As policies shift, the key to hassle-free returns will be staying organized. The ReturnGuru app, free for iPhone and Android, lets you snap pictures of your receipts, then saves them and reminds you as the deadline approaches to make returns. The new rules may take some getting used to. But if you expect great deals, that's part of the trade-off.

Last month, my colleague Mark Schoeff filed a story about a recent survey showing that more than half of college students who had completed financial planning coursework at three universities had decided not to sit for the national exam that would qualify them as certified planners. Apparently, many felt the test is too hard. I feel their pain. After completing seven college-level courses at the University of Virginia earlier this year, I was proud to be awarded a certificate in Certified Financial Planning. I thought balancing work and school was a challenge, but as I am half way through the process of cramming for the CFP exam in November, I realized that this is the hard part. I knew I needed a review course to prepare for the rigorous two-day, 10-hour exam. I had heard good things about several review programs including Keir, Zahn and Dalton. By process of elimination, I chose the Dalton Review because it offered an in-person review class in the Washington, DC area where I live. (So did the Zahn course but its schedule conflicted with an out-of-town wedding that I plan to attend). After registering for the course on-line and forking over the $1,195 payment, I received a box i

Any time an 800-pound gorilla moves into the neighborhood current residents have reason to be worried. And that is exactly what is happening with Apple, Inc. (AAPL) and Pandora (P) right now. Apple has been making headlines lately with the release of its new iPhone and operating system iOS7. But what is turning out to be one of the most interesting components of the release, the iOS7 comes embedded with Apple's new streaming radio service called iTunes Radio. Although iTunes Radio isn't dominating the headlines like the new iPhone 5C, the service is quickly making a big impact on the market and represents a huge threat to Pandora. At the very top, iTunes Radio offers more than 25 million songs compared to just 1 million for Pandora. That is a huge difference that makes Pandora look like a little kid trying to play with the big boys. Pandora is also in trouble because half of its 72 million users already use the iPhone, which gives its listeners instant access to a fierce competitor with a much bigger inventory of songs to choose from. And with hundreds of millions of iPhone users all across the world, Apple has a direct line to an entire new market that Pandora otherwise has little access to. There may be room for 2 big players in the streaming radio space, but even if that's true, Apple is going to pressure industry margins. That's because streaming radio service providers simply act as distributors and don't control any original content. That makes reach, distribution and margin a simple matter of scale, where the biggest player on the Street can afford lower margins and loss leaders in order to starve smaller players out of profitability. But it's clear the market doesn't care. Or isn't paying attention. Because Pandora is up 185% in 2013 and trading deep into an all-time high. But those gains aren't being driven by earnings, because Pandora is expected to lose 16 cents this year. 2014 doesn't look much better, when Pandora is supposed to earn a grand total of 6 ! cents. With shares just shy of $27, that has Pandora trading with a forward P/E of 450x. For comparison sake, it Apple had that same valuation, shares would be trading at $18,000.  The Takeaway Any time the biggest and baddest kid on the Street moves onto your block it's time to get nervous. And that's exactly what Apple is going, making a bold move into Pandora's turf with its entrance into the streaming radio market. But while this huge threat has emerged, Pandora is up 185% on the year and continues to move deeper into an all-time high. That makes Pandora at risk for both short and long-term losses as the market contemplates this new threat in the face of a ridiculously overvalued share price. For more top stock picks and analysis, check out a 4-week free trial to Michael's premium newsletter the iStock Growth Trader. The iStock Growth Trader is loaded with the hottest trends, the best stocks and detailed analysis that will keep your portfolio one step ahead of the game.

NEW YORK (TheStreet) -- We ended last week with Apple (AAPL) ($464.90) testing its 50-day and 200-day simple moving averages converged at $464.93 and $462.16 and with an upgrade to buy from hold according to www.ValuEngine.com. As we continue to focus on Apple, which clearly remains one of the benchmark stocks in the computer and technology sector, we also focus on earnings reports from three other stocks in this sector, plus earnings from one stock in the business services sector and another in the industrial products sector. The computer and technology sector is 25.4% overvalued with the business services sector 20.2% overvalued and the industrial products sector 21.4% overvalued. [Read: Google Laughs at the New iPhones] Apple is a key component of the Nasdaq, which led the major averages higher last week with the Nasdaq setting a new multi-year high at 3731.84 on Sept. 12. When Apple declined to the 50-day and 200-day SMAs the Nasdaq stalled while the other four major equity averages continued higher. At the Aug. 19 high at 513.74, Apple was rated hold and was testing my annual risky level at $510.64 and the 38.2% Fibonacci Retracement level of the decline from above $700 to below $400. This retracement level is $507.82. My annual value level remains $421.05 with an annual risky level at $510.64. Apple now has a buy rating with its 50-day SMA crossing above its 200-day SMA, which is a technical positive for the stock.  Chart Courtesy of Thomson/Reuters The decline in Apple shares prevented the Nasdaq from having a weekly close above annual and monthly risky levels at 3759 and 3772, which delays calling for new all-time highs. The question today is whether or not the Nasdaq can pop above these risky levels on the euphoria that Larry Summers will not be the next Federal Reserve chief. A gain of 37 points for the Nasdaq gets it up to 3759. [Read: Everything You Need to Know About Obamacare State Exchanges] My quarterly and annual value levels remain at 14,288/12,696 Dow Industrials, 1525.6 / 1348.3 S&P 500, 3284 / 2806 Nasdaq, 5348 / 5469 Dow transports, and 863.05 / 860.25 / 809.54 Russell 2000 with monthly and semiannual risky levels remain 16,336/16,490 Dow Industrials, 1766.8/1743.5 S&P 500, 3772/3759 Nasdaq, 7061/7104 Dow transports and 1093.07/1089.42 Russell 2000. Chart Courtesy of Thomson/Reuters The decline in Apple shares prevented the Nasdaq from having a weekly close above annual and monthly risky levels at 3759 and 3772, which delays calling for new all-time highs. The question today is whether or not the Nasdaq can pop above these risky levels on the euphoria that Larry Summers will not be the next Federal Reserve chief. A gain of 37 points for the Nasdaq gets it up to 3759. [Read: Everything You Need to Know About Obamacare State Exchanges] My quarterly and annual value levels remain at 14,288/12,696 Dow Industrials, 1525.6 / 1348.3 S&P 500, 3284 / 2806 Nasdaq, 5348 / 5469 Dow transports, and 863.05 / 860.25 / 809.54 Russell 2000 with monthly and semiannual risky levels remain 16,336/16,490 Dow Industrials, 1766.8/1743.5 S&P 500, 3772/3759 Nasdaq, 7061/7104 Dow transports and 1093.07/1089.42 Russell 2000. One of the five stocks previewed in this post is undervalued and three of the other five are overvalued by more than 20%. One stock is down 20.7% over the last 12 months, while three have gained between 17.7% and 45.6%. Four of the five are trading above their 200-day SMAs, which reflects the risk of reversion to the mean.

Reading the Table OV/UN Valued: Stocks with a red number are undervalued by this percentage. Those with a black number are overvalued by that percentage according to ValuEngine. VE Rating: A "1-engine" rating is a strong sell, a "2-engine" rating is a sell, a "3-engine" rating is a hold, a "4-engine" rating is a buy and a "5-engine" rating is a strong buy. Last 12-Month Return (%): Stocks with a red number declined by that percentage over the last 12 months. Stocks with a black number increased by that percentage. Forecast 1-Year Return: Stocks with a red number are projected to decline by that percentage over the next 12 months. Stocks with a black number in the table are projected to move higher by that percentage over the next 12 months. Value Level: Price at which to enter a GTC limit order to buy on weakness. The letters mean; W-weekly, M-monthly, Q-quarterly, S-semiannual and A-annual. Pivot: A level between a value level and risky level that should be a magnet during the time frame noted. Risky Level: Price at which to enter a GTC limit order to sell on strength. Software maker Adobe Systems (ADBE) ($47.76) is above its 50-day SMA at $47.02 with the 2013 high at $48.63 set on July 12. My semiannual value level is $44.85 with an annual risky level at $48.74. The provider of identity uniforms Cintas (CTAS) ($49.70) set a multi-year high at $49.99 on Sept. 10. My semiannual value level is $47.48 with a weekly pivot at $49.68 and monthly risky level $50.07. [Read: 'Secret IPO' or Not: You Won't Pay Attention to Twitter's Risks] Office furniture and seating designer Herman Miller (MLHR) ($26.34) set a multi-year high at $29.70 on Aug. 1 then declined to $25.08 on Sept. 6 holding the 200-day SMA at $25.52. My annual value level is $24.37 with a weekly pivot at $25.51 and semiannual risky level at $28.80. Software applications maker Oracle (ORCL) ($32.46) is trading between its 50-day and 200-day SMAs at $32.30 and $33.33. My annual value level is $30.81 with a monthly pivot at $32.33 and annual risky level at $34.68. [Read: For All Our Good, Let Student Debtors Go Bankrupt] TIBCO Software (TIBX) ($24.61) set a 2013 high at $25.76 on Aug. 1 then declined to $22.23 on Aug. 23 holding the 200-day SMA at $22.10. My monthly value level is $21.86 with a weekly pivot at $23.56 and semiannual risky level at $33.66. At the time of publication the author held no positions in any of the stocks mentioned. Follow @Suttmeier This article is commentary by an independent contributor, separate from TheStreet's regular news coverage. Richard Suttmeier has an engineering degree from Georgia Tech and a master of science from Brooklyn Poly. He began his career in the financial services industry in 1972 trading U.S. Treasury securities in the primary dealer community. In 1981 he formed the Government Bond Department at LF Rothschild and helped establish that firm as a primary dealer in 1986. Richard began writing market research in 1984 and held positions as market strategist at firms such as Smith Barney, William R Hough, Joseph Stevens, and Rightside Advisors. He joined www.ValuEngine.com in 2008 producing newsletters covering the U.S. capital markets, and a universe of more than 7,000 stocks. Richard employs a "buy and trade" investment strategy and can be reached at RSuttmeier@Gmail.com.

Budget experts say chances have increased that Washington will jeopardize government funding and borrowing in coming months. NEW YORK (CNNMoney) Budget experts are worried: The chances of a government shutdown and a harrowing ride to raising the debt limit have gone up in the past few weeks. That's due in part to a fractured Republican Party in the House and perceptions that President Obama is more vulnerable or unpredictable in the wake of the Syria debate. "We continue to believe disaster will be avoided across each of these issues, but the risk of negative outcomes has increased," Sean West, U.S. policy director for the Eurasia Group, said in a research note Thursday. Congress, of course, had a full agenda and a tight schedule before Syria took center stage. It must agree to spending levels for fiscal year 2014 -- or at least a short term extension of funding past Oct. 1, the first day of the fiscal year. If it fails to do so, non-essential parts of the federal government would shut down. It also must approve a debt ceiling increase by mid-October. If it doesn't, an independent think tank now estimates that the Treasury Department would not have enough cash coming in to pay all the country's bills in full sometime between Oct. 18 and Nov. 5. After the so-called "X" date, barring a higher debt ceiling, the country would default on some of its obligations. In both cases, many conservatives in the House want to make the defunding or delay of Obamacare a condition for their support to fund the government and raise the debt limit. That's a non-starter for Democrats and President Obama. What's more the administration has insisted it won't negotiate over the raising the debt limit. And, of course, there's the perennial disagreement over spending levels between the Republicans and Democrats, an old argument made much more complicated by the existence of the much-maligned sequester. When it comes to the deals that will be cut to assure approval of funding and a higher debt limit, budget experts aren't expecting much. "Big- and medium-term deals don't seem attainable now," said Robert Greenstein, executive director of the Center on Budget and Policy Priorities, at a National Journal event Thursday William Hoagland, senior vice president of the Bipartisan Policy Center, also is not holding his breath. "I've given up on grand bargains." Funding the government and raising the count! ry's legal borrowing limit, of course, are among the legislature's most basic functions. And yet, in recent years, both efforts have been stymied by political demands and brinksmanship. "It's extraordinary how dysfunctional our system has become and how casually we accept it," said Rudolph Penner, a former director of the Congressional Budget Office speaking at the same National Journal event. West and others who joined Greenstein, Hoagland and Penner think a short-term funding bill is likely to get through. But beyond that is anyone's guess. Republican Sen. Orrin Hatch, a keynote speaker at the event, was asked whether he thought there was a chance for a Christmastime crisis. "It's very possible," he said.

Popular Posts: 5 Ways to Get Rich With Natural GasHollyFrontier Eats Up Perpetual $3-Plus GasSell Coal Stocks — King Coal Gets Dealt Its Final Blow Recent Posts: Sell Coal Stocks — King Coal Gets Dealt Its Final Blow HollyFrontier Eats Up Perpetual $3-Plus Gas 5 Ways to Get Rich With Natural Gas View All Posts  HollyFrontier Eats Up Perpetual $3-Plus Gas It finally looks like old King Coal will be losing its crown as one of America's major producers of electric power. For investors, that means the time to bow out of coal producers could be at hand. The fossil fuel’s had a hard time going the last few years as natural gas has eaten its lunch in the cost department. Add in new hard-hitting regulations and it's easy to see why shares of coal producers have tanked, mines have been closed and a few producers have even filed for bankruptcy. Backing President Obama's promise to tackle climate change, the Environmental Protection Agency (EPA) recently announced strict new limits on newly constructed power plants — a plan designed to cut greenhouse-gas emissions. The new EPA rules build on the already proposed regulations that have caused the coal industry to effectively wither and could stop new coal-fired plants from being built all together. The core of these new regulations will put a cap on just how much carbon a power plant can throw off. For a coal-fired plant smaller than 850 megawatts, the facility will be limited to just 1,100 pounds per megawatt hour. That’s a tall order considering the average advanced plant in this size — fit with scrubbers and other carbon reducing equipment — puts out about 1,600 pounds per megawatt. Older coal fired plants emit around 1,700 to 1,900 pounds per megawatt. In order to reduce the amount toxic output, utilities are going to have to use a process called carbon capture and storage (CCS) — a process that is very expensive hasn’t yet been used on a commercial scale. American Electric Power (AEP) recently shut down tests on a CCS projects due to cost overruns, while Southern's (SO) first large-scale CCS plant under construction is facing local opposition and nearly $1 billion in cost overruns. The huge drop in allowed output, along with the need to use an unproven technology in new plants, isn’t sitting too well with various power producers and coal producers. Lawsuits and fighting on Capitol Hill are quickly becoming the norm for sector. Several industry lobbyist groups have already proposed ways to fight to the new regulations. However, all of these efforts still won’t save coal. Despite being a huge hindrance to the coal sector, the new regulations may not really matter. That's because natural gas continues to make building a new coal plant uneconomical. Even without adding in CCS facilities to a coal-fired plant, the cost is significantly higher than a comparable natural gas plant. Already fracking and abundant natural gas has changed the economics of producing power for utilities. Experts now predict that natural gas will need to rise to nearly $10 million British thermal units — roughly three times the current price — before coal really begins to make sense for power producers. Interestingly enough, new natural gas-fired plants already met the proposed EPA rules. According to the Energy Information Administration (EIA), none of the new power plants set to open or expand this year are using coal. Believe or not, there are actually more proposed nuclear facilities on the docket than coal plants. Overall, the EIA expects that U.S. coal consumption to remain essentially flat until 2030, before dropping off a cliff. That certainly hurts the chances of coal stocks surviving long-term. Already, the broad Market Vectors Coal ETF (KOL) is down about 21% year-to-date, while individual companies have fared much worst. Peabody Energy Corp. (BTU) — which is the largest U.S. producer — has fallen from more than $70 a share back in April 2011 to less than $19 a share today. Meanwhile, chief rival Arch Coal (ACI) has seen its stock price fall from $35 to less than $5 a share in the same time frame. While it may be tempting to snag up bargains in the industry, the continued assault against coal and the continued abundance of natural gas make coal stocks clear stocks to sell or avoid, depending on your current position. As of this writing, Aaron Levitt did not hold a position in any of the aforementioned securities.

|

Chart Courtesy of Thomson/Reuters The decline in Apple shares prevented the Nasdaq from having a weekly close above annual and monthly risky levels at 3759 and 3772, which delays calling for new all-time highs. The question today is whether or not the Nasdaq can pop above these risky levels on the euphoria that Larry Summers will not be the next Federal Reserve chief. A gain of 37 points for the Nasdaq gets it up to 3759. [Read: Everything You Need to Know About Obamacare State Exchanges] My quarterly and annual value levels remain at 14,288/12,696 Dow Industrials, 1525.6 / 1348.3 S&P 500, 3284 / 2806 Nasdaq, 5348 / 5469 Dow transports, and 863.05 / 860.25 / 809.54 Russell 2000 with monthly and semiannual risky levels remain 16,336/16,490 Dow Industrials, 1766.8/1743.5 S&P 500, 3772/3759 Nasdaq, 7061/7104 Dow transports and 1093.07/1089.42 Russell 2000.

Chart Courtesy of Thomson/Reuters The decline in Apple shares prevented the Nasdaq from having a weekly close above annual and monthly risky levels at 3759 and 3772, which delays calling for new all-time highs. The question today is whether or not the Nasdaq can pop above these risky levels on the euphoria that Larry Summers will not be the next Federal Reserve chief. A gain of 37 points for the Nasdaq gets it up to 3759. [Read: Everything You Need to Know About Obamacare State Exchanges] My quarterly and annual value levels remain at 14,288/12,696 Dow Industrials, 1525.6 / 1348.3 S&P 500, 3284 / 2806 Nasdaq, 5348 / 5469 Dow transports, and 863.05 / 860.25 / 809.54 Russell 2000 with monthly and semiannual risky levels remain 16,336/16,490 Dow Industrials, 1766.8/1743.5 S&P 500, 3772/3759 Nasdaq, 7061/7104 Dow transports and 1093.07/1089.42 Russell 2000.

Popular Posts: 5 Ways to Get Rich With Natural GasHollyFrontier Eats Up Perpetual $3-Plus GasSell Coal Stocks — King Coal Gets Dealt Its Final Blow Recent Posts: Sell Coal Stocks — King Coal Gets Dealt Its Final Blow HollyFrontier Eats Up Perpetual $3-Plus Gas 5 Ways to Get Rich With Natural Gas View All Posts

Popular Posts: 5 Ways to Get Rich With Natural GasHollyFrontier Eats Up Perpetual $3-Plus GasSell Coal Stocks — King Coal Gets Dealt Its Final Blow Recent Posts: Sell Coal Stocks — King Coal Gets Dealt Its Final Blow HollyFrontier Eats Up Perpetual $3-Plus Gas 5 Ways to Get Rich With Natural Gas View All Posts