Del Frisco's Restaurant Group, Inc. (DFRG) owns and operates 35 upscale steakhouses under the brands Del Frisco Double Eagle, Sullivans and Del Frisco's Grille. We believe the company's operating culture is best in class, its restaurants are unique and have great brand awareness, and have strong economics. There are 10 Double Eagles in marquee locations that dominate their markets as high end business destinations. We think that, over time, this division will more than double as the company meticulously adds best in class large units in major cities.

The company began development of its Grille concept last year and has now built seven stores, all of which are successful and have exceeded expectations. These restaurants have a broader menu, are packed at both lunch and dinner, and are working in both urban and suburban locations. This will be the primary growth vehicle and we believe that there easily can be 50 of these in time. We think the company can grow earnings at between 20-25% per year for the foreseeable future. However it trades at only a high teens multiple because current sales are soft in the Sullivans' units which matters less to the overall business as the other concepts grow. We believe the multiple should expand along with the earnings growth.

From Ron Baron's Baron Funds third quarter 2013 report.

| Currently 5.00/512345 Rating: 5.0/5 (1 vote) |

More Gurufocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

Have Received Their FREE 12-Page Warren Buffett Portfolio Report Get Yours FREE Here MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies | ||||||||||||||||||||||||||||||||||||||||||||||||

| Warren Buffett Portfolio | Ben Graham Net-Net | ||||||||||||||||||||||||||||||||||||||||||||||||

| Real Time Picks | Buffett-Munger Screener | ||||||||||||||||||||||||||||||||||||||||||||||||

Aggregated Portfolio

Thursday, January 30, 2014Mich. cape company turns kids into superheroes

They won't make you more powerful than a locomotive. And you might not be able to leap tall buildings in a single bound in one of their products.

But one Michigan company is moving faster than a speeding bullet — by selling superhero capes. Livonia-based Superfly Kids makes and sells capes — custom capes, to be exact — for kids and a few adults. And their sales have taken off like, well, Superman. From 2010 to this year, the company, owned by Holly Bartman and Justin Draplin, has seen its revenues leap from about $260,000 to an estimated $2.4 million. They are expected to double next year. It all began seven years ago when Bartman's son, Owen, who was turning 4, wanted a superhero party. "But he didn't want to be Batman or Spider-Man. He wanted to be his own superhero," said Bartman, who taught special education before launching the business. So, the mild-mannered mom made superhero capes — red ones, blue ones, black ones, all different colors — out of satiny material with lightening bolts and stars on them for the 15 or so kids invited to Owen's birthday party. The kids ran around the backyard, the flowing material trailing them as they went. Other parents and friends were impressed. One friend told her the capes were so good she should sell them. A few months later, she did just that. Bartman, 40, said she initially had no business plan — or any plan at all, really.  Employee Julie Boase sews a custom cape at Super Fly Kids on Thursday, Sept.26, 2013, in Livonia, Mich.(Photo: Andre J. Jackson, Detroit Free Press) Making capes was a hobby. She sold them online to make a little money. Orders would come in. She'd fill them. Then, even more orders would come. Aft! er a couple of years, the demand grew so big that she ran out of space in her house. That's when she started renting space for about $160 a month in a Farmington office building, where she met Draplin, now 33. Draplin, a fearless entrepreneur who thrives off creating businesses, had a marketing company in the same building. Every morning to get into his office, he had to step over material Bartman had rolled out in the hall to cut for her capes. Curious, Draplin asked her what she was doing. She told him she was in the superhero business. "At first, I thought there was no way she could make money selling capes," he said. "I couldn't wrap my brain around it." But later, he did some calculations. He estimated there are about 30 million kids age 7 and younger in the U.S. If they all wanted capes, which Superfly sells at about $30 each, the market could be huge — $900 million. So in 2009 Draplin went into business with Bartman. Up, up and away Bartman was more interested in designing and making the capes than selling them. She welcomed the partnership. Draplin bought capes from Bartman and resold them through his own website. After a few weeks, the two entrepreneurs decided to combine their businesses and the enterprise grew even faster. The duo have moved and expanded 10 times. They now work from a 7,600-square-foot factory in Livonia, and the company has 18 employees. They playfully answer the phone: "How can I save your day?"  Mike Siegrist prepares fabric to be made into customized capes at Super Fly Kids on Thursday, Sept.26, 2013, in Livonia, Mich.(Photo: Andre J. Jackson/ Detroit Free P Detroit Free Press) Inc. Magazine ranked Superfly Kids the second fastest-gr! owing pri! vate company in Michigan, and 227th fastest in the U.S., by revenues in the past three years. The magazine ranked it behind Marketplace Homes, also in Livonia, and ahead of LinTech Global, a software consulting firm in Farmington Hills. However, the owners acknowledge they made their first big mistake earlier this year when they overestimated how much they would sell in an online promotion. They were left with too much inventory. As a result, they expect their annual sales to be flat this year compared with 2012. The owners also concluded that to continue growing, they need to open new channels — not just online — to sell to customers. Despite the super growth curve, the decisions Bartman and Draplin make next likely will be the most challenging, and perhaps scariest, of their partnership. "It's a critical point in the company, and they have to explore whether they want to bring it to the next level," said Julie Gustafson, executive director of the Macomb-Oakland University INCubator in Sterling Heights. "If they make the wrong decisions, there's a chance of failure." 'A lot of fun' In many ways, Bartman and Draplin said, they are a good team. Bartman said she tends to focus on the products and quality control — and takes a slow and steady approach. Draplin wants to grow the company as fast and as big as he can. He calls himself a spaghetti thrower, trying a lot of ideas to see which ones stick. In addition to capes, the company sells superhero cuffs and masks, T-shirts, tutus, belts, crowns and stuffed toys. It has created its own comic book. (Characters in the book are named Owen, Lily and JJ.) Superfly Kids even sells a line of adult-sized capes that can be customized with corporate logos. Their merchandise is made in the Livonia plant. Draplin said he wants to broaden both their product lines and distribution to reach more retailers. He also has contemplated multilevel sales techniques similar to those of Amway and Mary Kay cosmetics.! To! expand even quicker, they are considering whether to seek outside investors, which could require relinquishing control of the enterprise. "I never thought I'd be doing this for a living," Draplin said. "This is a lot of fun." Wednesday, January 29, 20143 Stocks Under $10 Moving HigherDELAFIELD, Wis. (Stockpickr) -- At Stockpickr, we track daily portfolios of stocks that are the biggest percentage gainers and the biggest percentage losers. >>5 Hated Earnings Stocks You Should Love Stocks that are making large moves like these are favorites among short-term traders because they can jump into these names and try to capture some of that massive volatility. Stocks that are making big-percentage moves either up or down are usually in play because their sector is becoming attractive or they have a major fundamental catalyst such as a recent earnings release. Sometimes stocks making big moves have been hit with an analyst upgrade or an analyst downgrade. Regardless of the reason behind it, when a stock makes a large-percentage move, it is often just the start of a new major trend -- a trend that can lead to huge profits. If you time your trade correctly, combining technical indicators with fundamental trends, discipline and sound money management, you will be well on your way to investment success. >>5 Rocket Stocks for a Volatile Week With that in mind, let's take a closer look at a several stocks under $10 that are making large moves to the upside. pSivida pSivida (PSDV) develops products to deliver drugs and biologics primarily in the U.S. and the U.K. This stock closed up 8.3% to $4.96 in Tuesday's trading session. Tuesday's Range: $4.52-$4.96 From a technical perspective, PSDV ripped sharply higher here right off some near-term support at $4.46 with decent upside volume. This move is quickly pushing shares of PSDV within range of triggering a major breakout trade. That trade will hit if PSDV manages to take out some near-term overhead resistance levels at $5.14 to $5.45 and then once it clears its 52-week high at $5.60 with high volume. Traders should now look for long-biased trades in PSDV as long as it's trending above some near-term support at $4.46 or above $4 and then once it sustains a move or close above those breakout levels with volume that hits near or above 291,389 shares. If that breakout hits soon, then PSDV will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $6.50 to $7. China Zenix Auto International China Zenix Auto International (ZX), an investment holding company, engages in the research, development, production, and sale of commercial vehicle wheels to aftermarket and original equipment manufacturers. This stock closed up 8.6% to $3.01 in Tuesday's trading session. Tuesday's Range: $2.78-$3.01 From a technical perspective, shares of ZX ripped sharply higher here right above its 50-day moving average of $2.66 and back above its 200-day moving average of $2.98 with decent upside volume. This stock has been uptrending strong for the last two months, with shares moving higher from its low of $2.11 to its recent high of $3.15. During that uptrend, shares of ZX have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of ZX within range of triggering a major breakout trade. That trade will hit if ZX manages to take out Tuesday's high of $3.01 to some more near-term overhead resistance at $3.15 with high volume. Traders should now look for long-biased trades in ZX as long as it's trending above its 50-day at $2.66 or above $2.60 and then once it sustains a move or close above those breakout levels with volume that hits near or above 72,953 shares. If that breakout triggers soon, then ZX will set up to re-test or possibly take out its next major overhead resistance levels at $4 to its 52-week high at $4.27. YuMe YuMe (YUME) provides digital video brand advertising solutions. This stock closed up 8% to $7.95 in Tuesday's trading session. Tuesday's Range: $7.27-$8.09 From a technical perspective, YUME spiked sharply higher here right above some near-term support at $7.15 and back above its 50-day moving average of $7.89 with lighter-than-average volume. This stock recently put in a major bottoming chart pattern, since shares of YUME have found buying interest over the last two months each time it has pulled back to near $7 a share. Shares of YUME are now starting to spike higher off those support levels and the stock is quickly moving within range of triggering a big breakout trade. That trade will hit if YUME manages to take out Tuesday's high of $8.09 to some more near-term overhead resistance at $8.80 with high volume. Traders should now look for long-biased trades in YUME as long as it's trending above Tuesday's low of $7.27 or above $7 and then once it sustains a move or close above those breakout levels with volume that hits near or above 177,215 shares. If that breakout hits soon, then YUME will set up to re-test or possibly take out its next major overhead resistance levels at $9.37 to $10.15. To see more stocks that are making notable moves higher, check out the Stocks Under $10 Moving Higher portfolio on Stockpickr. -- Written by Roberto Pedone in Delafield, Wis.

Follow Stockpickr on Twitter and become a fan on Facebook. At the time of publication, author had no positions in stocks mentioned. Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including CNBC.com and Forbes.com.You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24. Monday, January 27, 2014Tesla Is The New Bubble StockIf it looks like a bubble and acts like a bubble, it's a bubble. Tesla Motors (TSLA) is the new bubble stock. There is a lot of money to be made and lost in a bubble stock, but the trouble is bubble stocks are for trading not investing. Once a bubble is underway almost anything can happen in the short term, but in the long term the outcome of a return to market normality is extremely likely. That doesn't mean you can't make a lot of money out of the madness, it's just a very dangerous game. Risk equals reward and bubbles are immensely risky, which is why there is reward to be had. As such, bubble stocks draw investors to them like the clichéd moths to a flame. Bubbles are lovely to behold. Look at this delightful chart:

Let's go closer. Fascinating. What's that burning smell? Wow it's me! Of course the best thing to do is ignore these kinds of stocks but that sadly is not going to happen. The reason TSLA has gone to the moon–shares are up more than 500% over the last 12 months–is everyone wants in. Saying "avoid" is futile. Saying Tesla's stock price is too high is not the same as saying Tesla is not a brilliant company. Tesla has done a great job. The stock isn't through the roof for nothing. You just have to see one of its cars on the road to want to own it. It is so "lick-able" it looks like an iPhone with wheels. What did they do to the paint job to give it that opalescence? Or is that the new owners just polish it 24/7? Who knows, we shouldn't care. Perception can only be reality for so long. We should stick to the land of comparative valuations and likely outcomes. So Tesla is a great company with a great product, but is it a good value investment? Let's keep that for later, but you can guess right off what my opinion is: no it isn't. Is its stock going to rise? Why not? Once "superstar" status is achieved normal laws of the market no longer apply. If Tesla wasn't a superstar stock it would be the easiest call in the world to short Tesla, but with the U.S. market's bi-polar tendencies, this is the first thing to avoid doing at this stage. There is always plenty of time to short Tesla and it will be a long time after it made perfect sense to do so. Superstar stocks can stay in orbit a lot longer than you'd ever guess. So go long? Going long Tesla is purely a trading position, there is no long-term reason to cling onto this company at these heady valuations. Not unless TSLA invents anti-gravity paint. I know no one wants to hear this but Tesla is worth twice Fiat, the owners of Ferrari. Tesla and Porsche are worth about the same. You could buy Peugeot Peugeot five times over. Should Tesla be worth half of GM? The market thinks so and the market is always correct. Right? Special Offer: Get the names of five rock–solid companies with real, tangible growth drivers and big money making potential in the free report 5 Bargain Stocks To Buy Now. So how to play the stock? Well first off, if you aren't in, leave this one alone unless you want to play a high risk gambling game with your money. Tesla is now pure speculation. At the Open: Dow Industrials Fall 100 Points as Shutdown Continues, Companies Furlough WorkersStocks continue their slide today as the government shutdown continues and politicians appear set to drag the debt ceiling into the debate.  Associated Press Associated Press The S&P 500 has dropped 0.7% to 1,682.30, while the Dow Jones Industrials have fallen 100 points, to 0.7% to 15,033.21. Nomura’s Alastair Newton explains the risks: Following the impasse over the continuing resolution, we now see a non-negligible possibility that Congress and the Administration will fail to reach agreement on the debt ceiling without there being a technical default first. The main risk, as we see it, is that moderate Republicans will hold out beyond 17 October to try to head off possible de-selection by the Tea Party in upcoming primaries, even though related attempts to roll back "Obamacare" are doomed. Nevertheless, even if the deadline (which may now be later than 17 October) for a deal passes, we see only a very low probability of a default on Treasuries. However, coupled with the impact of the second round of the sequester, pending a resolution we do expect to see: Even decent jobless claims data wasn’t enough to lift stocks this morning. Miller Tabak’s Andrew Wilkinson sums up the data and its implications: The Labor Department issued another healthy and clean claimant count delivering the lowest four-week moving average reading since May 2007. The headline reading of 308,000 claims once again came in below a survey average of 315,000 while prior weekly data was revised up by only 2,000. We continue to wonder quite when the momentum will show up in stronger payrolls – something denied by ADP in its September report and something we are likely to be deprived of on Friday by the government shutdown… The claims level implies that in a period of rising political uncertainty firms are holding onto workers at a time when the economy outside of Washington appears to be moving ahead with reasonable momentum. In the face of such uncertainty and with lack of clarity on the outlook for the economy such momentum is insufficient to prompt the Fed to commence the tapering process. Will claims stay that way? Already, manufacturers have started to furlough workers–even if they didn’t show up in today’s numbers. The Wall Street Journal reports: The partial shutdown of the federal government is leading to layoffs and production disruptions at defense contractors and some manufacturing companies. United Technologies Corp. (UTX) said on Wednesday that it is preparing to furlough nearly 2,000 workers at its Sikorsky unit, which makes Black Hawk helicopters for the Defense Department, and may have to idle several thousand more workers at its Pratt & Whitney and UTC Aerospace units if the shutdown drags on for weeks. United Tech has dropped 0.5% to 104.51, while Boeing (BA) has fallen 0.7% to $116.97, both helping to weight down the Dow. Over at the S&P 500, HCP (HCP) has dropped 2.8% $40.62, making it the biggest loser in the benchmark, after the healthcare REIT fired its CEO. PVH (PVH), meanwhile, has gained 5.7% to $124.06, making it the S&P 500′s biggest winner at 9:48 a.m., after the company said it would sell its GH Bass division. Texas Industries (TXI) has plunged 7.5% to $61.99 after the construction company said it earned 1 cent a share, below forecasts for 2 cents. Sunday, January 26, 2014Commitments of Traders - September 6, 2013The first things to look for in the non-commercials net change indicator are group themes. Are there similar movements in the COT data in several markets within a group? This week the answer would be no. Against the background of geopolitical concerns and a US holiday last Monday, movements in COT data have been mostly muted. Still, there was some movement again in soybeans, as well as meal and oil. And copper continues to coil but non-commercials backed off their threat to cross to the net long side of the market. This RadarScreen capture shows the net change in the net non-commercial position, expressed as a percent of the total non-commercial open interest, in the Commitments of Traders (COT) data released Friday, September 6. Hot Performing Companies To Own For 2015This indicator and more information about COT reports are available in the Analysis Concepts paper titled "Commitments of Traders: Breaking Down the Open Interest." As detailed in the paper, the intention is to follow the money flow of large speculators: money managers, hedge funds, etc.

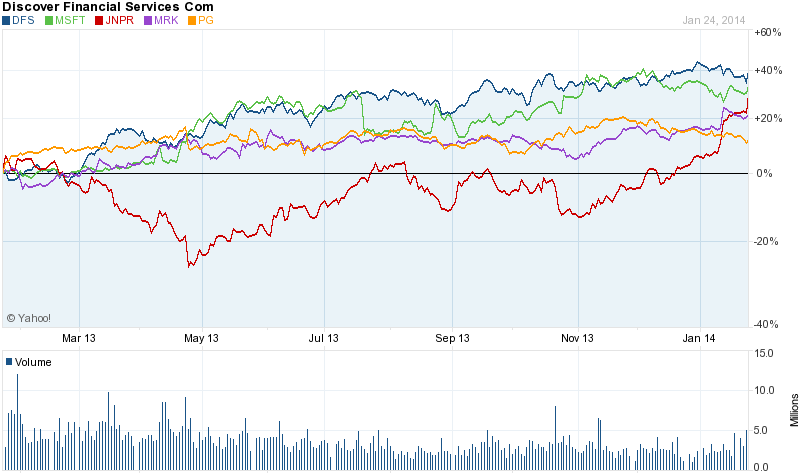

You can read more of this blog here. Written by Stanley Dash, VP, Applied Technical Analysis, TradeStation. Follow TradeStation Saturday, January 25, 2014Five Big Stocks That Escaped The Market Carnage Sell-OffThe stock market was pounded on Friday, making for a very bad week and a rough start for January. Still, not all is lost. A few stocks managed to avoid the carnage. Despite a drop of 318 points in the Dow Jones Industrial Average (-1.96% to 15,879.11) and despite a drop of 2.1% in the S&P 500 Index (-38.17 to 1,790.29), three of the thirty Dow stocks closed up on Friday. The emerging markets were taking it on the chin and being set up for a really bad week ahead, and the currency woes may start biting into key US industrial exports. 24/7 Wall St. covered the four stocks which dominated the DJIA losses on Friday, but these are five key stocks that avoided the market carnage. Again three are DJIA stock and two of which are active S&P 500 names. Microsoft Corporation (NASDAQ: MSFT) managed to turn in a gain of almost 2.1% to $36.80 on Friday. You can thank its earnings for this, as well as analysts taking their targets higher for the software and technology giant. The criticism remains over the post-Ballmer transition, so imagine how well it might have done (or will do ahead) if the CEO replacement is handled adequately and rapidly. Procter & Gamble Company (NYSE: PG) managed to gain 1.2% to $79.18 after beating earnings expectations. This is also one of the top defensive stocks of the Dow, so investors who want stock market exposure without so much risk might be swinging money and parking it in consumer products too. P&G guided for earnings to rise 7% to 9% per share in 2014. Not bad, not bad at all. Merck & Co. Inc. (NYSE: MRK) was a bit of a mystery rise, particularly when you consider that Pfizer Inc. (NYSE: PFE) fell by almost 3% on Friday. Perhaps it was just a bounce that was needed after several days of serious losses that robbed almost all of the big gain from the prior week. Merck shares closed up $0.38, or 0.74%, at $51.98 on Friday. Maybe being a defensive stock in the drug sector was another driving force, but the relative performance between it and Pfizer is not really a normal trading observation. There were two other standout winners as well which are large and actively traded stocks day in and day out. Juniper Networks, Inc. (NYSE: JNPR) managed to hit another annual high of $28.75, and closed on Friday up just over 6.5% at $27.72. That 38 million shares stands out heavily as well, considering that the average volume is almost 9 million share per day. Juniper also saw at least three key analyst upgrades as well. Having 59% quarterly profit growth is not the norm in this market, and Jana Capital is actively pressing the company to do better in managing costs and returning capital to holders. Juniper has about $4 billion in cash and liquidity (versus what is now a $14 billion market cap), yet it pays no dividend. Our quick calculation of a 25% payout of adjusted operating earnings ahead would yield a dividend of about 1.4% without Juniper eating into its huge treasure chest already on the books. Discover Financial Services (NYSE: DFS) rose after beating fourth quarter estimates. The credit card issuer said that its loan balances were up 4%, while its sales volume rose by 3%. Shares were up as much as 5% at one point, but a 2% broad market correction managed to bring down those gains to “only” 2.8% to $53.88. This is still close to its high of $56.20 for the year and the stock’s high on Friday was $55.50. Being a financial stock and closing up on a day like Friday is impressive by almost all counts, even if the closing price was only 13-cents above the daily low. The more than 9 million shares which traded was about 3-times normal trading volume for Discover. Friday was without a doubt a bad day for the stock market. Many have been calling for a real correction after 26% DJIA gains and 29% S&P 500 gains in 2013. Even in a sell-off, there is that saying “There’s always a bull market somewhere.” This is just proof again that some stocks can rise handily regardless of the market. Best Casino Stocks To Watch For 2015Below is a one-year performance chart of each of these five stocks from Yahoo! Finance. The gains may seem huge on Friday, but the gains versus the strong market over the last year may put this in even more perspective.

Thursday, January 23, 2014For Harbinger’s Philip Falcone, a Ban for LifeThe simple statement by the Securities and Exchange Commission (SEC) that Philip A. Falcone of Harbinger Capital Partners has “agreed to be barred from the securities industry for at least five years” may list a time period, but effectively he is out of the business for life. In an industry that has had its share of phoenixes, Falcone has made too many mistakes to claw his way back. Breaking the law is perhaps the least among them. The SEC took a long time to catch up to Falcone. Many of the misdeeds that triggered penalties against him occurred in 2006. Once the agency was able to get a negotiated settlement, it became clear how little leverage the hedge fund manager ever had: "Falcone and Harbinger engaged in serious misconduct that harmed investors, and their admissions leave no doubt that they violated the federal securities laws," said Andrew Ceresney, Co-Director of the SEC's Division of Enforcement. "Falcone must now pay a heavy price for his misconduct by surrendering millions of dollars and being barred from the hedge fund industry." After Falcone made investors huge sums by betting against mortgage-backed securities just as that market collapsed, he committed the worst sin a hedge fund manager can — he lost his investors almost all of their money, based on a single, wild gamble. Top Consumer Stocks For 2015Falcone decided he was smarter than the executives at all the major wireless, cable and telecom companies combined. They had not made efficient use of spectrum to distribute broadband at the lowest prices possible. For a total of about $5 billion, the company he backed, LightSquared, bought satellite frequency and even launched a satellite of its own. All of this money was invested on the premise that he could set fees that would undercut the markets. Falcone made two awful calculations. The first is that the U.S. government would approve the use of the spectrum he bought for his new broadband distribution scheme. The chance that would work ended quickly. The spectrum conflicted with that used for GPS devices. The government was not about to cripple the massive franchises that had grown from that technology. His second mistake was one Falcone never got to make. He never had a practical plan to compete with entrenched broadband providers. Most of the leaders in the field have multibillion dollar annual budgets and tens of thousands of employees. Falcone will be well shy of 60 when his ban expires five years from now. Wall Street may forgive him for breaking the law. Losing most of his investor’s money is another thing. Tuesday, January 21, 2014‘Call of Duty’ returns with new twists

The developers of Call of Duty: Ghosts have drawn up a game-changing battle plan for the billion-dollar video game franchise.

Out Tuesday for PlayStation 3, Xbox 360, Wii U and PCs ($60, ages 17-up), the military fighting game has a globe-trotting storyline penned with the help of Oscar-winning screenwriter Stephen Gaghan (Traffic). The post-apocalyptic near-future tale – the U.S. has suffered a devastating attack – plays on family ties and introduces a loyal and lethal secret weapon: Riley, an attack-trained German Shepherd. A new Call of Duty also means a new iteration of the crazily-popular online multiplayer game mode. This year's model has an improved character customization scheme with 20,000 combinations. For the first time, you can create a woman soldier – a nod to the growing female player base. In a new squads mode, you can match up against computer-controlled opponents to improve your online skills. And an entirely new mode, Extinction, lets four players work together to fight off an alien invasion. STORY: More on multiplayer Publisher Activision and main development studio Infinity Ward made the right move shaking things up a bit, says analyst P.J. McNealy of Digital World Research. "You always have to take risks to avoid franchise fatigue, and new stories are needed," he says. Timed to the game's launch is a new mobile Call of Duty app for Android, iOS and Windows 8 devices that lets players customize characters and track progress in a Call of Duty Clan Wars metagame. Call of Duty has been reliable for Activision. Each of the last four annual releases have surpassed $1 billion in sales with more than 20 million copies sold each. Even though Ghosts may not be the top-selling game of 2013 – that honor will go to Grand Theft Auto V with 29 million copies shipped already – Ghosts will scare up huge numbers. "This franchise has been the biggest and best franchise in this console cycle," McNealy says. "The huge sell-in numbers for (GTA) bodes wel! l for (Ghosts) coming in north of 25 million units." However, Wedbush Securities analyst Michael Pachter projects that retail sales will dip as much as 10%. And the arrival of new consoles later this month from Sony and Microsoft could, he says, "hurt sales initially, mostly because of the drain on wallet share." Ghosts is also available on the PlayStation 4, out Nov. 15, and the Xbox One (Nov. 22). Many Best Buy stores will begin selling the game at 12:01 a.m. Tuesday and stores in West Los Angeles and Minneapolis will have Infinity Ward developers on hand for special events. Retailer GameStop expects 200 or more customers at most of its more than 4,000 stores for midnight sales events. Ghosts "is on track" to be the most-reserved game in 2013 for the retailer, says president Tony Bartel.  A screen shot from the video game 'Call of Duty: Ghosts,' out Nov. 5, showing the canine companion, Riley.(Photo: Activision/Infinity Ward) Developer Infinity Ward dropped the Modern Warfare universe of its three previous games. The plot follows what's left of the special forces including the player's character, Logan, his brother and their father, a commander. "We added a very strong family element," says the game's executive producer Mark Rubin. "That experience of how that plays out for you as a player really adds a new story depth." And players will also get a canine's eye view of the action when they deploy Riley in the game. Two Navy Seals-trained German Shepherds were used in motion capture sessions to create the in-game dog's natural moves. It worked so well that Riley evolved "from an auxiliary role to more of a teammate," says animator Zach Volker.  In the making of the video game 'Call of Duty: Ghosts,' two trained German Shepherds were used in motion capture sessions so that animators had realistic movements to assign to the in-game dog, Riley.(Photo: Activision/Infinity Ward) Sunday, January 19, 20143 Big Stocks to Trade (or Not)BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you. >>5 Rocket Stocks to Buy This Week From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market. Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd. While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today. >>5 Stocks Ready to Break Out These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. That's especially true now that earnings season is officially underway. And when there's a big catalyst, there's often a trading opportunity. Without further ado, here's a look at today's stocks. Pandora Media Nearest Resistance: $22 >>5 Stocks Triggering Breakouts on Big Volume Pandora Media (P) was one of the highest-volume stocks on the NYSE on Friday, down double-digits on the firm's earnings results. While the firm's 4-cent earnings per share for the quarter came in at double analysts' estimates, guidance wasn't what market participants were hoping for, and they're selling. Despite the setback last week, a glimpse at Pandora's chart shows that all isn't exactly lost. This stock is still in a well-defined uptrend that's got a reasonably good proxy for support just below the 50-day moving average. If you're looking to build a position in Pandora, I'd suggest waiting for the next white-bar day and buying. Aeropostale Nearest Resistance: $12.50 >>5 Big Trades You Can't Miss Aeropostale (ARO) is a post-earnings trainwreck after it announced second quarter numbers after the bell yesterday. The stock got flooded with negative comments from analysts after releasing its numbers, with some suggesting that financial distress could be a real concern if ARO stays unprofitable as long as they expect. Morgan Stanley puts the firm's bear case price target at $2, which is nearly an 80% drop even from here. As bad as the fundamentals look for ARO, the technicals look even worse. Shares broke support a week ago, and have been in free-fall ever since. Friday's selloff only accelerates the drop. This is the definition of a "falling knife". Don't try to catch the bottom in ARO. Petrobras Nearest Resistance: $15 >>5 Stocks Warren Buffett Is Buying in 2013 A bounce in a basket of beaten-down emerging markets late last week helped to spur huge trading volume in Brazilian oil firm Petrobras (PBR). PBR has had a rough year in 2013, dropping 23% on weakness in the global economy coupled with a strong dollar. But shares bottomed in July and have spent the last few weeks consolidating in a rectangle with resistance at $15. While shares flirted with a $15 breakout on Friday, it wasn't confirmed. If we see PBR hold above that level, consider it a buy. If you decide to buy PBR on a $15 move, you'd better be nimble. While this stock sports an upside target around $19, it's still a bullish setup within the context of a long-term bearish trend. I wouldn't want to be caught long for too long in PBR this summer. To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

Follow Stockpickr on Twitter and become a fan on Facebook. At the time of publication, author had no positions in stocks mentioned. Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji Friday, January 17, 2014Jim Cramer's 6 Stocks in 60 Seconds: DECK PXD NUS AA DDS PPG (Update 1)Top Warren Buffett Stocks To Buy Right NowCheck out Jim Cramer's latest trading recommendations on "Action Alerts Plus". (Updates from 10:45 a.m. ET with closing information.) NEW YORK (TheStreet) -- Here's what Jim Cramer had to say on CNBC's "Squawk on the Street" Friday.

Stifel Nicolaus upgraded Pioneer Natural Resources (PXD) to buy from hold. "This stock has just been a horrendous performer," Cramer said. He thinks it still has access to a lot of oil in the Permian basin. PXD was 82 cents lower at $174.70. Wednesday, January 15, 20143 Stocks Spiking on Big Volume10 Best Growth Stocks To Own Right NowDELAFIELD, Wis. (Stockpickr) -- Professional traders running mutual funds and hedge funds don't just look at a stock's price moves; they also track big changes in volume activity. Often when above-average volume moves into an equity, it precedes a large spike in volatility. >>5 Hated Earnings Stocks You Should Love Major moves in volume can signal unusual activity, such as insider buying or selling -- or buying or selling by "superinvestors." Unusual volume can also be a major signal that hedge funds and momentum traders are piling into a stock ahead of a catalyst. These types of traders like to get in well before a large spike, so it's always a smart move to monitor unusual volume. That said, remember to combine trend and price action with unusual volume. Put them all together to help you decipher the next big trend for any stock. >>5 Rocket Stocks to Stomp the S&P in 2014 With that in mind, let's take a look at several stocks rising on unusual volume recently. Dana Holding Dana Holding (DAN) engages in the design, manufacture and supply of driveline products, technologies and service parts for vehicle manufacturers worldwide. This stock is trading up 5.8% at $19.94 in Tuesday's trading session. Tuesday's Volume: 5.91 million >>5 Stocks Poised for Breakouts From a technical perspective, DAN is ripping higher here back above both its 50-day moving average at $19.32 and its 200-day moving average at $19.82 with heavy upside volume. This move is quickly pushing shares of DAN within range of triggering a major breakout trade. That trade will hit if DAN manages to take out some near-term overhead resistance levels at $20.35 to $20.50 and then once it clears its gap-down day high from last October at $21 with high volume. Traders should now look for long-biased trades in DAN as long as it's trending above Tuesday's low of $19.15 or above some more near-term support at $18.78 and then once it sustains a move or close above those breakout levels with volume that's near or above 2.78 million shares. If that breakout triggers soon, then DAN will set up to re-fill some of its previous gap-down-day zone that started near $23. Nxstage Medical Nxstage Medical (NXTM), a medical device company, develops, manufactures, and markets products for the treatment of kidney failure, fluid overload, and related blood treatments and procedures. This stock is trading up 8.4% at $12.26 in Tuesday's trading session. Tuesday's Volume: 1.02 million >>5 Stocks Insiders Love Right Now From a technical perspective, NXTM is soaring higher here with above-average volume. This stock has been uptrending strong over the last month and change, with shares moving higher from its low of $8.77 to its intraday high of $12.40. During that uptrend, shares of NXTM have been making mostly higher lows and higher highs, which is bullish technical price action. Traders should now look for long-biased trades in NXTM as long as it's trending above Tuesday's low of $11.55 and then once it sustains a move or close above its 200-day moving average of $12.30 with volume that's near or above 543,708 shares. If we get that move soon, then NXTM will set up to re-test or possibly take out its next major overhead resistance levels at $13.50 to $14. Any high-volume move above those levels will then give NXTM a chance to tag its 52-week high at $14.64 to $16. SodaStream International SodaStream International (SODA) engages in the development, manufacture, and sale of home beverage carbonation systems that enable consumers to transform ordinary tap water instantly into carbonated soft drinks and sparkling water. This stock is trading up 2.5% at $37.89 in Tuesday's trading session. Tuesday's Volume: 3.36 million From a technical perspective, SODA is trending higher here with heavy upside volume. This stock recently gapped down sharply from over $50 to under $37 with monster downside volume. That gap lower pushed shares of SODA into oversold territory, since its current relative strength index reading is 23.32. Oversold can always get more oversold, but it's also an area where a stock can experience a powerful rebound higher from. Traders should now look for long-biased trades in SODA as long as it's trending above Tuesday's low of $36.38 and then once it sustains a move or close above Tuesday's high of $38.14 with volume that's near or above 1.07 million shares. If we get that move soon, then SODA will set up to rebound sharply higher off oversold conditions and potentially tag $42.50 to $45. To see more stocks rising on unusual volume, check out the Stocks Rising on Unusual Volume portfolio on Stockpickr. -- Written by Roberto Pedone in Delafield, Wis.

Follow Stockpickr on Twitter and become a fan on Facebook. At the time of publication, author had no positions in stocks mentioned. Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.Monday, January 13, 20145 Best Stocks To Buy Right NowChina�� stocks rose the most in a week, led by financial companies, after valuations on the benchmark index dropped to a four-month low. Poly Real Estate Group Co. and Haitong Securities Co. advanced at least 1.4 percent, driving financial stocks to the biggest gain in two weeks. Drugmaker Yunnan Baiyao Group Co. and Goertek Inc., a supplier to Apple Inc., surged to record highs. BYD Co., the automaker partially owned by Warren Buffett�� Berkshire Hathaway Inc., jumped 6.5 percent after the Shanghai Securities News reported the government may issue subsidies for renewable-energy cars. The Shanghai Composite Index (SHCOMP) rose 1.4 percent to 2,205.50 at the close, rebounding from the lowest level since Dec. 24. The benchmark index slipped 0.2 percent yesterday after a private report showed decelerating manufacturing growth. Data today showed service industries expanded at a slower pace. ��his is a technical rebound after investors digested bad manufacturing data yesterday,��said Mao Sheng, an analyst for Huaxi Securities Co. in Chengdu. 5 Best Stocks To Buy Right Now: Croda Intl(CRDA.L)Croda International Plc, a marketing and technology company, produces and sells specialty chemicals. The company offers personal care products, including biochemical actives for sebum regulation, wrinkle reduction, skin firming, and protection from free radicals; traditional and microwave plant extracts for use in personal care and industrial applications; and natural oils for personal care applications. It also provides excipients, solubilisers, plant and marine oils, proteins, and biopolymers for the nutritional, pharmaceutical, dermatological, and animal health care markets; and formulation aids and adjuvants under Atlox, Atplus, and Crovol brand names for various applications, including emulsifiable concentrates, microemulsions and O/W emulsions, seed treaters, soluble liquids, suspension concentrates, suspo emulsions, water dispersible granulates, and wettable powders. In addition, the company offers specialty products for formulators in the automotive and industrial lubricant markets; oleochemicals and specialty surfactants for resin manufacturers, formulators, and additive producers; emulsification and demulsification solutions for oilfield, mining, and water treatment markets; polymer additives for use in applications, such as polyolefins, PVC, styrenics, polyamides, and biopolymers; and natural specialty ingredients for home care and tissue, car care, and industrial and institutional applications. Further, it provides ingredients, additives, and processing aids for various consumer applications, including construction chemicals, emulsion technology, technical and industrial fiber chemicals, advanced materials, ceramic ink-jet ink additives, bitumen additives, leather auxiliaries, paper chemicals, candles and waxes, and rubber compounders. The company has operations in Europe, North America, Latin America, and Asia. Croda International Plc was founded in 1925 and is headquartered in Goole, the United Kingdom. 5 Best Stocks To Buy Right Now: Apollo Global Management LLC(APO)Apollo Global Management, LLC is a publicly owned investment manager. The firm primarily provides its services to pension and endowment funds, institutional investors, individual investors, pooled investment vehicles, and corporations. It manages client focused portfolios, hedge funds, real estate funds, and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe. Its alternative investments include investment in private equity and real estate markets. The firm's private equity investments include traditional buyouts, distressed buyouts and debt investments, corporate partner buyouts, distressed asset, turnaround, corporate restructuring, special situation, acquisition, and industry consolidation transactions. Its fixed income investments include distressed debt, senior bank loans, and value oriented fixed income securities. The firm seeks to invest in chemicals; commodities; consumer and retail; oil an d gas, metals, mining, agriculture, commodities, distribution and transportation; financial and business services; manufacturing and industrial; media distribution, cable, entertainment, and leisure; energy, packaging and materials; and satellite and wireless. It seeks to invest in companies based in across North America with a focus on United States, and Europe. The firm employs a combination of contrarian, value, and distressed strategies to make its investments. It conducts an in-house research to create its investment portfolio. The firm seeks to acquire minority positions in its portfolio companies. Apollo Global Management, LLC was founded in 1990 and is headquartered in New York, New York with nine additional offices in North America, Europe, and Asia. Advisors' Opinion:

Top Insurance Stocks To Buy Right Now: Diploma(DPLM.L)Diploma PLC supplies specialized technical products and services in Europe, North America, and internationally. The company?s Life Sciences segment supplies consumables, instrumentation, and related services to the healthcare and environmental industries. This segment offers consumables and instruments used in the diagnostic testing of blood, tissue, and other samples in hospital pathology laboratories; specialty electrosurgery and endoscopy equipment, and consumables for use in the operating rooms and endoscopy suites; analyzers for detecting and measuring specific elements in liquids, solids, and gases, as well as containment enclosures for potent powder handling; and equipment and services for the monitoring and control of environmental emissions. The company?s Seals segment supplies hydraulic seals, gaskets, cylinders, components, and kits for heavy mobile machinery and industrial equipment. This segment provides a next day delivery service for seals, seal kits, and cylinders used in heavy mobile machinery applications; gasket and seal kits for heavy duty diesel engines, transmissions, and hydraulic cylinders used in off road and marine applications; hydraulic kits to install attachments on excavators; O-rings, moulded and machined parts, PTFE products, and shaft seals; and precision seals for hearing aids and heavy duty seals for wind power mills. The company?s Controls segment supplies specialized wiring, connectors, fasteners, and control devices for technically demanding applications. This segment offers wiring, interconnect, electro-mechanical, and fastener products for use in a range of technically demanding applications in various industries, including defense and aerospace, motorsport, energy, medical, and general industrial; flexible braided products and multi-core cables; and control devices used in the sensing, measurement, and control of temperature and pressure. Diploma PLC was incorporated in 1931 and is based in London, the United Kingdom. 5 Best Stocks To Buy Right Now: Imperial Tobacco (ITYBY.PK)Imperial Tobacco Group PLC (Imperial Tobacco), incorporated on August 6, 1996, is a tobacco company. Through the Company�� total tobacco portfolio it provides consumers a range of brands and products, including cigarettes, fine cut tobacco, cigars and snus. Its total tobacco portfolio includes fine cut tobacco, cigars, rolling papers and tubes. Its non-European Union (EU) markets consist of Eastern Europe, Africa and the Middle East and Asia and markets of the United States and Australasia. Its international cigarette brands include Davidoff, Gauloises Blondes and West. It offers services across the whole logistics value chain to its customers, including order reception, storage and stock management, order preparation, transport and distribution, invoicing and collection and customer services. Its business has two aspects: tobacco logistics and non-tobacco logistics. Imperial Tobacco comprises two distinct businesses: Tobacco and Logistics. The Tobacco business comprises the manufacture, marketing and sale of tobacco and tobacco-related products, including sales to (but not by) the Logistics business. The Logistics business comprises the distribution of tobacco products for tobacco product manufacturers, including Imperial Tobacco, as well as a range of non-tobacco products and services. The Logistics business is run on an operationally neutral basis.5 Best Stocks To Buy Right Now: EMCOR Group Inc. (EME)EMCOR Group, Inc. provides electrical and mechanical construction, and facilities services primarily to commercial, industrial, utility, and institutional customers in the United States, the United Kingdom, and internationally. The company offers various electrical and mechanical systems, including electric power transmission and distribution systems, such as power cables, conduits, distribution panels, transformers, generators, uninterruptible power supply systems, and related switch gear and controls; premises electrical and lighting systems, including fixtures and controls; low-voltage systems comprising fire alarms, and security and process control systems; voice and data communications systems, including fiber-optic and low-voltage cabling systems; and roadway and transit lighting and fiber-optic lines. It also provides heating, ventilation, air conditioning, refrigeration, and clean-room process ventilation systems; fire protection systems; plumbing, processing, and piping systems; controls and filtration systems; water and wastewater treatment systems; central plant heating and cooling systems; cranes and rigging; millwrighting; and steel fabrication, erection, and welding systems. In addition, the company offers facilities services comprising industrial maintenance and services; outage services to utilities and industrial plants; commercial and government site-based operations and maintenance; military base operations support; mobile mechanical maintenance and services; floor care and janitorial; landscaping, lot sweeping, and snow removal; facilities and vendor management; call center; building systems installation and support; and technical consulting and diagnostic services. Further, it provides small modification and retrofit projects; retrofit projects; and program development, management, and maintenance services for energy systems. EMCOR Group, Inc. was founded in 1966 and is headquartered in Norwalk, Connecticut. Advisors' Opinion:

Sunday, January 12, 2014Will a Merger Take US Airways to the Upside?With shares of US Airways (NYSE:LCC) trading around $23, is LCC an OUTPERFORM, WAIT AND SEE. or STAY AWAY? Let's analyze the stock with the relevant sections of our CHEAT SHEET investing framework. T = Trends for a Stock’s MovementUS Airways operates and owns passenger and freight airline carriers. Consumers and companies across the nation are now looking to travel at an increasing rate. Since air travel is quicker and less expensive, it is becoming a common transportation method for many. As costs decrease and flights become more efficient, look for business and retail customers to fly more than ever. US Airways and AMR Corp.'s (AARMQ.PK) American Airlines will reportedly have to make antitrust concessions at more than just Ronald Reagan International Airport outside of Washington, D.C., if the airlines want the U.S. Department of Justice to drop a suit blocking their proposed merger. A source familiar with the talks recently told Reuters that US Airways and American will have to give up takeoff and landing slots at airports across the country for the Justice Department to approve. The DoJ has said the merger will cut down too much on competition, while US Airways and American counter that the merger would make them more competitive against other large airlines. T = Technicals on the Stock Chart Are StrongUS Airways stock has been surging higher in the past several years. The stock is currently trading near highs for the year and looks ready to continue. Analyzing the price trend and its strength can be done using key simple moving averages. What are the key moving averages? The 50-day (pink), 100-day (blue), and 200-day (yellow) simple moving averages. As seen in the daily price chart below, US Airways is trading above its rising key averages, which signal neutral to bullish price action in the near-term.  Source: Thinkorswim Taking a look at the implied volatility (red) and implied volatility skew levels of US Airways options may help determine if investors are bullish, neutral, or bearish.

What does this mean? This means that investors or traders are buying a very significant amount of call and put options contracts as compared to the last 30 and 90 trading days.

As of Monday, there is average demand from call buyers or sellers and low demand by put buyers or high demand by put sellers, all neutral to bullish over the next two months. To summarize, investors are buying a very significant amount of call and put option contracts and are leaning neutral to bullish over the next two months. On the next page, let’s take a look at the earnings and revenue growth rates and the conclusion. E = Earnings Are Mixed Quarter-Over-QuarterRising stock prices are often strongly correlated with rising earnings and revenue growth rates. Also, the last four quarterly earnings announcement reactions help gauge investor sentiment on US Airways’s stock. What do the last four quarterly earnings and revenue growth (Y-O-Y) figures for US Airways look like and more importantly, how did the markets like these numbers?

US Airways has seen decreasing earnings and rising revenue figures over the last four quarters. From these numbers, the markets have been upbeat about US Airways’s recent earnings announcements. P = Average Relative Performance Versus Peers and SectorHow has US Airways stock done relative to its peers – Southwest Airlines (NYSE:LUV), Delta Air Lines (NYSE:DAL), and United Continental (NYSE:UAL) — and sector?

US Airways has been an average relative performer, year-to-date. ConclusionUS Airways is an airline that operates passenger and freight planes. The company, AMR Corp., and the Department of Justice are currently attempting to reach a settlement regarding the US Airways and American Airlines merger. The stock has exploded higher in 2013 and is currently trading near its yearly highs. Over the last four quarters, earnings have been decreasing while revenues have been rising, which has produced optimistic investors. Relative to its peers and sector, US Airways has been an average year-to-date performer. Look for US Airways to OUTPERFORM. Saturday, January 11, 2014How the Smartphone Is Changing the Auto IndustryOne trend you should be aware of as an investor is that of the "connected car". Your vehicle can connect with the outside world through a dedicated modem, such as General Motors' (NYSE: GM ) 17-year-old OnStar service, or -- increasingly these days -- through your smartphone. At the recent Connected Car Conference in New York City, Roger Lanctot of Strategy Analytics spoke about the role of smartphones and modems in the vehicle: Besides entertainment, they can help sell cars, route motorists, and facilitate commerce through various payment options for tolls, parking, etc. If done properly, a connected car even can save lives and make driving safer. Our roving reporter Rex Moore attended the conference, and was able to speak to Roger about the role of the smartphone in the car. In today's video, the question of why the smartphone is forcing a move away from an OnStar-like subscription model is explored. Who's really smart? Top 10 Biotech Stocks To Watch For 2014Friday, January 10, 2014Fisker assets will go to public auction, judge…

WILMINGTON, Del. — The judge in the Fisker Automotive bankruptcy case has ruled that assets of the failed electric car maker will go to public auction.