Summary:

It's hard to have the best of both worlds, but Suncor Energy (SU) offers an attractive 2.1% dividend and a 7% production growth for its investors. The stock is trading at 11.4X 2014 earnings and 4.9X EV/EBTIDA, which is low compared to other large oil and gas producers. The author sees a 13.5% upside for the stock in the next 12 month.

About The Company:

Suncor Energy is the largest energy company in Canada based on market capitalization. Suncor is an integrated oil company with both upstream and downstream operations.

Suncor's upstream operations center around its oil sands operation in the Wood Buffalo region of Alberta. The oil sands division consists of oil sands mining and in-situ operations which extract and upgrade raw bitumen. Suncor also holds stakes in oil sands Joint Ventures projects such as Syncrude Canada (12% working interest), Fort Hills Mining (40.8% working interest), and Joslyn Mining (36.75% working interest). Furthermore, Suncor has an attractive upstream E&P business in Eastern Canada and U.K. Suncor's E&P business is attractive because it has low sustaining capital expenditures and high free cash flow. Suncor uses those free cash to fund its oil sands business.

Suncor's downstream business includes 4 refineries located in Sarnia (Ontario,Canada), Edmonton (Alberta, Canada), Montreal (Quebec, Canada) and Commerce City (Colorado, U.S.) with total refining capacity of 460 Mbbls/d. Suncor's goal is to utilize low cost feedstock from its own oil sands operation and capture the pricing differential between heavy crude (Western Canadian Select) and WTI. In the past year, Suncor was able to generate significant cash flows through its lucrative refining operations and its price realized on its upstream production was 93% of Brent pricing due to its refining business. The integrated business model, having both upstream and downstream operations, is powerful.

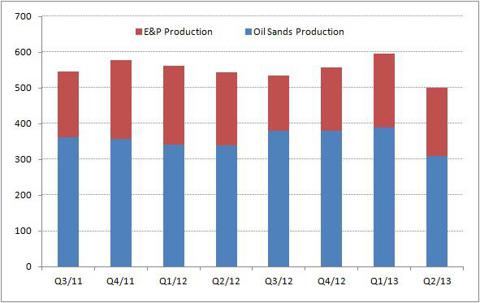

Graph 1: Suncor's Production History in Last 8 Quarters (in

(click to enl! arge)

Source: Company Filings. The production was low last quarter because of various maintenance including a major turnaround at its U1 upgrader. Q3 production approach the 600 Mbbls/d level.

Investment Thesis:

The investment thesis in Suncor is simple: It provides both an attractive dividend and compelling growth potential. It's hard to find a oil and gas stock that has a 2.1% yield while providing a stable 7% production growth. Also, it has a solid balance sheet and dedicated management team.

Suncor's Dividend Growth Potential:

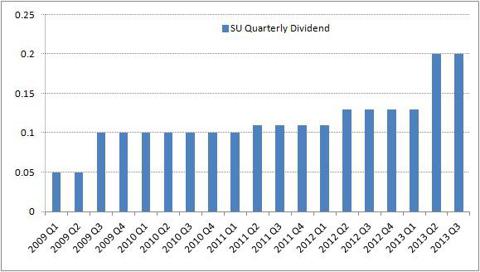

Suncor has grown its dividend by a compounded rate of 21.4% in the last 5 years. Also, it spent over 2 billions in buybacks in the last two years. The company still has a $1.8 billion share buyback program that could purchase up to 49 million shares (around 3.2% of shares outstanding). Suncor raised its quarterly dividend by 54% from $0.13 per quarter to $0.20 in April. The dividend could be raised by 5-10% ($0.01-0.02 per quarter) again in April,2014 when the company re-visits its payout policy. With annual cash flow from operations at $10 billion and capital expenditures at $7 billion, there is about $3 billion of free cash flow, which only $1.2 billion per year is committed to the current dividend. Thus, investors should expect further dividend growth in the years ahead.

Graph 2: Dividend History of Suncor Since 2009

(click to enlarge)

Source: Company IR Website. Dividends did not change materially from 2010-2012 because the company focused on reducing debt levels after its Petro-Canada acquisition, which reduced free cash flow available. With debt at a manageable level and cash flows growing, future dividend hikes are on the horizon.

Suncor's Growth Plan:

In ! addition ! to its dividend, Suncor also has an attractive growth profile. First of all, Suncor has various debottlenecking projects that increase production in its oil sands business as announced in its Q2 report. Oil sands production grew from 350 Mbbls/d in January to 433 Mbbls/d in August and it is expected to grow in the future. Various projects in its oil sands and E&P businesses will provide the stable 7% production growth. Secondly, Suncor has a lot of flexibility given it has 6.9 billion barrels in proven reserves and another 23.5 billion barrels in contingency resources. At the current production rate, Suncor can maintain production for over 34 years and over 100 years if the contingency resources are included. Therefore, Suncor can ignore short term fluctuation in energy prices and solely focus on developing its resources optimally. Finally, Suncor can fund its growth entirely out of its own cash flow and does not need additional outside capital, which lowers Suncor's cost of capital.

Valuation:

The intrinsic value of the shares, calculated by the author, is $42.75 or 5.5X 2014's consensus EBITDA estimate of $13 billion. The peer average is around 5.5X so the author believes this multiple is justified. The calculated intrinsic value of $42.75 implies a further 13.5% appreciation from the current share. For U.S. investors, the price target is in Canadian Dollars because the reporting currency of Suncor is in Canadian Dollars. $42.75 translates to a price target of $41.10 for SU's NYSE listed shares using today's USDCAD rate of 1.04.

Suncor's trading multiples have been depressed in recent years because of poor capital allocation and operational issues such as low utilization of its facilities. Nonetheless, when Steve Williams was promoted to CEO in May 2012, he made concrete plans to improve capital allocation and increase reliability at existing facilities. Not only has operational and financial results improved considerably since May 2012, but also Suncor attracted Warren Buffett's! attentio! n. Berkshire Hathaway (BRK.A) bought 17.8 million shares of Suncor in Q2 and the author expects Buffett to continue to build his stake further similar to how Berkshire built its stake in DirectTV (DTV) and General Motors (GM). For Suncor investors, keep an eye out for Berkshire's 13F that is scheduled to release in mid-November.

Table 1: SU Quick Facts

Dividend Yield | 2.1% |

P/CF (Fiscal 2014E) | 5.3X |

P/E (Fiscal 2014E) | 11.3X |

Return on Capital Employed (Average Last 4 Quarters) | 12.0% |

Production (FY 2012 in bbls/d) | 549,000 |

Future Production Growth (2013-2020) | 7% CAGR |

2P Reserves (in MMbbls) | 6,900 |

Source: Company Q2 Report and Investor Presentation

Conclusion:

Suncor offers both growth and income to investors, a rare combination. Suncor watchers should keep an eye out when it reports Q3 earnings on October 30 at 10:00pm EDT. The author expects financial and operational results will improve in the next 4 quarters and the stock will rise towards the author's $42.75 price target.

Source: Suncor Energy Offers Stable Growth And Attractive Dividends For Long-Term InvestorsDisclosure: I am long SU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: This article is for informational purposes only and does not constitute an offer to buy or sell any securities discussed in the article. The stock mentioned in this article does not represent financial advice. The target price presented in this article are based on current information and are subject to change without further notice. Investors are recommended to conduct further due diligence before committing capital to any investment.

No comments:

Post a Comment