For the second time in three years, the U.S. government is again running perilously close to reaching the debt ceiling -- but Wall Street is indicating that its level of concern this time around is very different from last time.

While the situation in 2011 was a little different than it is today, as the government did not shut down entirely, the government was again just days away from hitting the debt ceiling in July 2011 -- which meant the U.S. government would not be able to pay its debts.

After intensive weekend negotiations, U.S. lawmakers signed a deal on Sunday July 31, 2011 that prevented the government from moving past the deadline that would inhibit its ability to borrow any more money. President Obama said then, "the uncertainty surrounding the raising of the debt ceiling for both businesses and consumers has been unsettling, and just one more impediment to the full recovery that we need, and it was something we could have avoided entirely."

While it was unsettling for both businesses and consumers, how nervous was Wall Street during that time? One way to gauge that is by looking at the yields of U.S. Treasuries. If investors thought probability of the government defaulting would go up, they would demand higher returns from the principal way the government borrows money.

A quick glance at U.S. Treasury yields in the days before the crisis reveals:

Source: U.S. Treasury Department.

As you can see in the chart above -- investors got increasingly nervous, and therefore the yields of U.S. Treasuries shot upwards as the probability of default became more and more real. But following the resolution of the of the debt ceiling fight -- the rates fell precipitously.

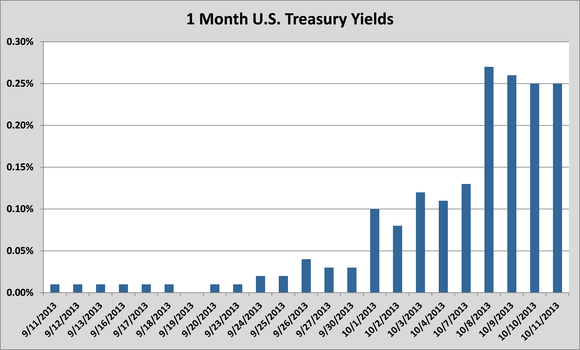

One glance at the 2013 rate curves reveals that investors are taking the current proposition of default much more seriously than they did in 2011:

Source: U.S. Treasury Department.

As you can see, rates have shot upwards to almost double what they were in 2011. While it isn't exactly fair to say that investors think that the probability of default is twice what it was in 2011, it is certainly striking to see how dramatically the rates have risen through the first 11 days of October.

But even more so than rates moving upwards is the fact that one-month Treasury rates stood at 0.16% just two business days before a potential default would have occured in 2011. Whereas in today they now stand at 0.25% almost two weeks before a potential meltdown would occur.

This all comes just days after BlackRock (NYSE: BLK ) joined the two largest money market mutual funds, JPMorgan Chase (NYSE: JPM ) and Fidelity, in announcing they had sold their short-term holdings of U.S. Treasuries that would come due around the time of a potential default.

While Bob Corker noted Monday morning that a deal is "very possible" -- Wall Street has already shown that it believes this time may be very different.

More on the debt ceiling

The U.S. government has piled on more than $10 trillion of new debt since 2000. Annual deficits topped $1 trillion after the financial crisis. Millions of Americans have asked: What the heck is going on?

The Motley Fool's new free report, "Everything You Need to Know About the National Debt," walks you through with step-by-step explanations about how the government spends your money, where it gets tax revenue from, the future of spending, and what a $16 trillion debt means for our future. Click here to read the full report!

No comments:

Post a Comment