Positive trends have Silicon Valley tech giants Apple (NASDAQ: AAPL ) , Facebook (NASDAQ: FB ) , and the century-old International Business Machines (NYSE: IBM ) poised for future success in each of their diverse, but somewhat interrelated, businesses.

Investors who take notice can be rewarded.

Advertisers like Facebook

Assuming continued low operating costs, mostly for labor and relatively inexpensive computer infrastructure, an increase in the number of ads placed on Facebook should also translate into higher profits for the company.

For Facebook, the key to more ads is growth in the number of users, especially from mobile platforms like smartphones and tablets. A positive trend is sales of those products have been increasing.

The user base, now at over 1 billion strong, has been increasing at a brisk pace and there is no reason to think that it will slow down. Demographics are on the side of Facebook. Every day more people who are likely to buy products advertised on its website become connected to the Internet.

Hot High Tech Stocks To Buy For 2014

Big in data

Though the ages, IBM was the prototypical tech company. Known for making both large mainframes and personal computers, the NY-based company has sold its PC business and is transitioning away from hardware. It is now big in business-to-business services and specialized software applications.

It is also big in data, Big Data that is. IBM is at the forefront of the revolution in collecting, processing, and disseminating huge chunks of digital information that are used in a variety of different enterprises including social networks and online retailing.

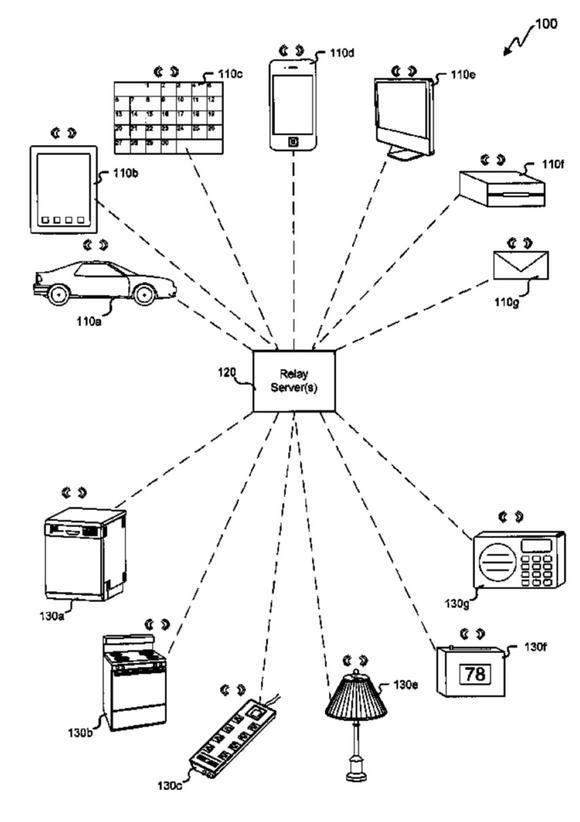

IBM is also big in another business, the so-called "Internet of things" in which ordinary items such as light fixtures, thermostats, toasters, and even your car are interconnected and controlled using apps on smartphones and tablets.

Although the total return to shareholders who reinvest dividends and EPS gains have been relatively good over the recent past, IBM would like to reverse subpar revenue growth. The company is betting on Big Data and the Internet of things to do that.

IBM Total Return Price data by YCharts

New gadgets will drive growth

There are plenty of reasons to think that Apple will continue the success it has had in gadgets and subsequent growth opportunities for investors.

The company shows no signs of slowing down on the innovation front which, along with its "think differently" corporate culture, has been responsible for much of Apple's phenomenal success since co-founders Steve Jobs and Steve Wozniak started tinkering with computers while they were growing up in Silicon Valley in the 1970's.

Over the last few months Apple has refreshed many of its major product lines adding new features to the iPhone such as 64-bit computing architecture, larger capacity battery, one-touch access using a fingerprint sensor in the home button, and in the case of the new "5c" model, very vivid colors. The iPad Mini has been fitted with a Retina Display like its larger cousin, which itself has been made lighter and thinner than its previous version. The "bigger" iPad Air is a gem of a device and one analyst wrote "it is the best tablet I've ever reviewed."

Perhaps a little further down the road Apple will also be betting on the success of its own vision for the Internet of things. A recent patent the company received describes a "home control system," centered on Apple devices of course, and probably using Big Data techniques pioneered by IBM and other companies. This system might allow you to walk from room-to-room in your house or office and have apps loaded on your iPhone or "smart watch" automatically turn on and off various items.

Source: U.S. Patent Office

Foolish conclusion

Ongoing trends in the fairly different, but in many ways alike, businesses of tech giants Apple, IBM, and Facebook have each company poised for growth down the road. Shareholders that look into the future with them can profit.

No comments:

Post a Comment