Today is the big Federal Reserve decision and we will see if they taper or not, and if they do whether that figure exceeds the expected range of $10-15 billion. The economy has given us some poor data in recent weeks and if we do happen to see the Fed decrease their activity in the fixed income markets then we would hope that they would also provide language which would enable them to continue at the new monthly rate should numbers continue to weaken.

Look for markets to search for direction before 2:00 P.M. but to see a lot of volatility following the rate decision and then Bernanke's press conference which starts at 2:30 P.M.

Chart of the Day:

Many are saying that even with the Fed Tapering that the ten year treasury will remain below 3% for the time being as most, if not all, of the expected move is priced in already.

(click to enlarge)

Source: Yahoo Finance

We have economic news today and it is as follows:

MBA Mortgage Index (7:00 a.m. ET): Est: N/A Actual: 11.2%Housing Starts (8:30 a.m. ET): Est: 910kBuilding Permits (8:30 a.m. ET): Est: 943kCrude Inventories (10:300 a.m. ET): Est: N/AFOMC Rate Decision (2:00 p.m. ET): Est: 0.25%Asian markets finished mixed today:

All Ordinaries -- down 0.28%Shanghai Composite -- down 0.29%Nikkei 225 -- up 1.35%NZSE 50 -- up 0.12%Seoul Composite -- down 0.39%In Europe, markets are also mostly higher this morning:

CAC 40 -- up 0.57%DAX -- up 0.47%FTSE 100 -- up 0.15%OSE -- down 0.24%Telecom

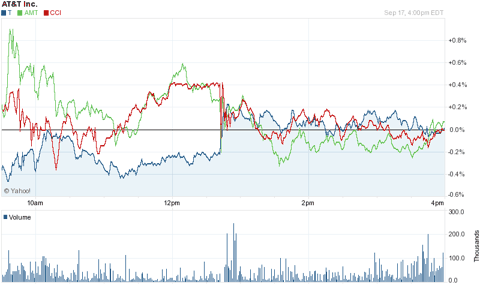

The news we found most interesting yesterday was the story regarding AT&T (T) that broke during the session that they were looking to offload their tower assets. The deal could fetch as much as $5 billion and many are looking at this as a precursor to a much larger deal where AT&T would look to expand overseas via a large acquisition.

AT&T shares spiked on the news of a po! ssible sale of their towers while American Tower and Crown Castle both retreated on the news.

(click to enlarge)

Source: Yahoo Finance

The two names which come to mind as potential buyers are American Tower (AMT) and Crown Castle International (CCI) as the assets would be natural for them to purchase. It would be a large transaction though which would be about 1/6th the current market cap of American Tower and 1/4th the size of Crown Castle's market cap. Another possible buyer could be a hedge fund, and although the are few names out there specializing in this industry at the end of the day it is a real estate game and all about the leverage and cash flows. Readers should watch this story because if AT&T does in fact sell its towers it might be set to make a move on the chess board.

Consumer Goods

We continue to watch this Herbalife (HLF) story, merely out of amusement and curiosity although there is a great deal to be learned from here. This battle of the hedge fund titans is turning out to be everyone against Ackman and with Herbalife having hit a new all-time high at $73.91/share yesterday it is blatantly obvious that Mr. Ackman is losing this short bet. Our guess is that most of the shorts who piled on along with Mr. Ackman have long since closed their positions, undoubtedly lending a hand to the recent run-up, and that most of the attention is not upon the company's results so much as upon the results of Mr. Ackman's position and hedge fund in general. He has sold some winners recently and if that was to take some money off of the table or to cover outflows to clients we do not know, but the worse his Herbalife trade performs the more transactions like that we will see (selling off winners rather than admit defeat).

Grocery Stores

In our article on September 16th (located here) we said we were still bullish the grocers and t! hought th! at Safeway (SWY) would continue to be a winner along with the industry. Apparently we were not alone in that thinking as the company announced yesterday that they were putting in place a poison pill which will be good for one year in order to keep anyone from building a stake larger than 10% in the company. The move was prompted by Jana Partners taking a 6.2% stake in the company and the hope of management is that this one year period will either cool the heals of Jana or allow the two parties to work together rather than going hostile. We personally dislike poison pills, but in this case it should not be seen as a negative as we doubt anyone was considering assembling a stake at or above that 10% level. Investors cheered the news and sent shares higher by $2.75 (9.74%) to close at $30.99/share on extremely heavy volume of 29.8 million shares.

Source: Today's Market: Telecom M&A Heating Up And Other Names OutperformingDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment